Forex trading strategies: definition and types

In order to successfully Forex trade, a trader must carefully consider a trading plan. It consists of a set of trading strategies which help a trader to close transactions by adhering to algorithms.

What kind of trading strategies are there? How to apply them? How to choose an appropriate strategy? Read the answers to these questions in this article.

Types of trading strategies

Forex trading strategies are a set of rules and algorithms used for trading on the currency market. They consist of a list of conditions by which transactions are executed. There are three types of Forex trading strategies: short-term, mid-term and long-term.

Short-Term Trading Strategies

They are designed for a trade within the interval of 1 to 3 days. Short-term strategies are based on day trading principles. Their aim is to complete a large number of deals within one trading day and gain profit due to high liquidity and volatility of assets.

Examples of short-term trading strategies

1) Scalping. It means execution of a large number of transactions during one day. Within the scalping strategy traders close the position a few minutes after it is opened.

For successful scalping-trading, it is important for traders to be able to react quickly to market changes and understand the principles of technical analysis. These skills will help to determine the most profitable points of entry and exit of trades quickly.

2) 50 pips a day. It means trading currency pairs with high liquidity. Traders open two opposite postponed positions for each of currencies and when the price begins to change – one of positions is activated, and the second is automatically canceled.

Mid-Term Trading Strategies

The trader opens positions on mid-term strategies for a time interval from 2 to 7 days. They require deeper market analysis and understanding of trading instruments: currency pairs, bank metals, stock indexes, cryptocurrencies and other assets. The advantage of mid-term strategies is that the trader does not need to follow the market changes every minute and react to them quickly.

Examples of mid-term trading strategies

1) Trading according to trends. Trader follows the market tendencies and opens a position in the most profitable point on the results of analysis. If the price of asset goes up – trader opens a trade for buying, if the price begins to fall – for selling.

2) 5 daily candlesticks. The strategy is based upon the analysis of the British pound price dynamics. The specific thing is that the British pound often demonstrates a continuous fall or rise in price within 1-2 working weeks. This allows the trader to track on the chart the most profitable entry points.

Long-Term Trading Strategies

Such strategies are also called position trading. The trades on these strategies may last from a week to several months. Long-term strategies are based not only on technical analysis, but also on fundamental analysis. It is important for a trader to follow the global market trends and news, which can affect the market in the long term.

Long-term strategies are not designed to profit from the volatility of currencies and price swings within one trading day. A trader can open only one trade, but the income from it will be higher than in short-term trading. It is better to start your Forex trading studies with long-term strategies because they take less time and reduce risks.

Examples of long-term trading strategies

1) Weekly. A Forex trading strategy on a weekly chart. A trader can use various indicators, which will help to plan the correct way to enter and exit the trade. Weekly chart shows a lot of information about the market, which makes trading more flexible and stable.

2) Price Action. This is a strategy that relies on analysis of price behavior. A trader analyzes daily and weekly charts, identifies levels and candlesticks on them. Based on these data, he makes transactions based on the pattern of price behavior.

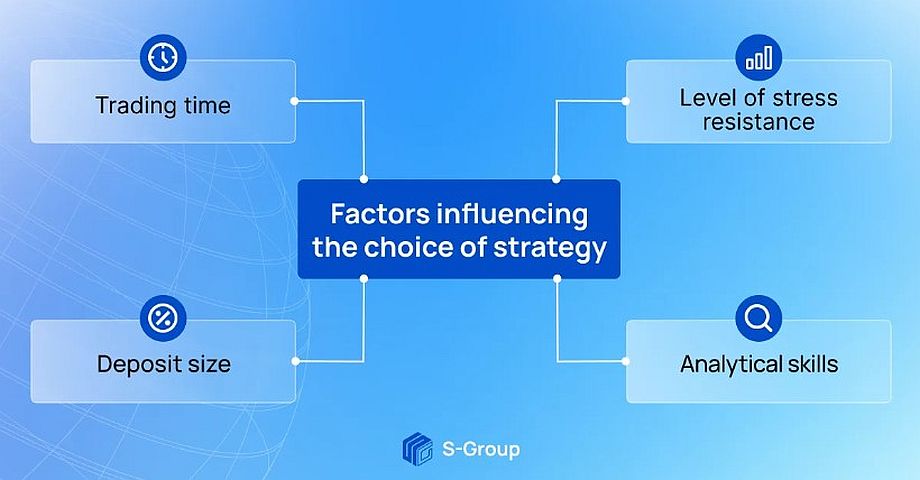

How to choose a trading strategy

Regular practice in trading helps a trader to understand which trading strategies are suitable for him. The choice depends on several factors:

– the time which a trader is ready to spend on trading;

– the level of trader’s stress resistance and readiness for risk;

– size of initial deposit;

– understanding of technical and fundamental analysis.

Short-term trading strategies are suitable for those who are able to analyze the situation quickly and make instant decisions. These strategies require full involvement in trading, so traders should dedicate the whole day to them. Discipline and risk management are important in short-term strategies, as traders must monitor even the smallest changes on the market and react to them.

Mid-term trading strategies are suitable for those who are just starting out in trading. They imply a more flexible trading with less risk. Traders do not need to spend the whole day trading, because their trades will not depend on the daily currency volatility. The entry barrier to these trades is higher than in short-term trading and profits are less frequent which does not suit all traders.

Long-term trading strategies are suitable for traders who have their main job and do not have time to follow the news and trends on a daily basis. Trading with such strategies allows you to earn higher profits per trade and is an effective tool for passive income.

Summary

Many trading strategies have been developed for Forex trading. They differ in the presence of indicators and patterns, time intervals, as well as trading tools for trading. It is important for traders to practice a lot in trading and try out different strategies in order to create a successful trading plan and gradually increase their capital.

Experienced traders do not advise to trade on the templates of the existing strategies. The best option is to choose the basic principles from the proven strategies and personalize your approach based on personal experience and analysis. In this case the trader’s skills improve and trading becomes more effective.