Scalping in the Forex market

Earnings on financial markets attract many investors with the opportunity to make good profits. But for trading to be successful, it is important for an investor to understand how different trading strategies work and in what situations it is optimal to use each of them.

In this article, let’s talk about the strategy of scalping in the forex market, how it works, as well as its advantages and disadvantages.

What is scalping and how it works

Scalping is a Forex trading strategy that is based on technical analysis of charts. The main objective of scalping is to make as many deals as possible and get a small profit from each of them. That is, the investor does not hold a position for several hours, and immediately after opening a transaction closes it within the first minutes or even seconds. Such short transactions are made by scalpers, i.e. market participants who have a strict plan for entering and exiting the market.

As part of their strategy, scalpers rely on high market volatility and strive to make a large number of trades to buy and sell assets, earning on price differences. It is important for a scalper to be able to detect in time the highly liquid assets, the value of which fluctuates many times during one day. If an asset is not liquid, scalping will not work because it is the liquidity that guarantees the perfect price when entering or exiting the market.

For scalping in the forex market trades to be successful, scalpers need to devote a large amount of time to them and have a disciplined approach. Also, scalpers need to be fully focused on interpreting and tracking changes in the chart in order to react properly to price movements.

During trading, scalpers adhere to three operating principles.

1. Staying in the market for a short period of time and holding the asset, which minimizes the chance of getting into unfavorable conditions and the risk of losses.

2. Focusing on small price movements in order to gain a lot of small profit in a short period of time.

3. Understanding the frequency of small movements that occur even when the market seems calm. There are still small movements in the price of an asset that scalpers tend to exploit.

While other trading styles, such as position trading, rely on fundamental analysis to determine trades, scalp traders focus on technical trading techniques. Technical analysis involves examining historical movements in the price of an asset along with tracking current trends. To do this, scalp traders use a variety of tools and charts. With historical prices, scalpers observe patterns and predict future price movements when planning a trade.

The difference between scalping and day trading

The daily trading scheme is close to scalping due to the large number of transactions within one trading session. But despite the similarities, they are different strategies.

The main differences between day trading and scalping lie in the closing speed of deals and position holding duration.

– Duration of position holding. Day traders can keep the position from one to two hours, while scalpers close the position almost immediately after it is opened.

– Speed. Intraday traders trade at an average speed, while scalpers seek immediate results. Before other traders see an opportunity, the scalper will open and close their trade.

Advantages and disadvantages of scalping

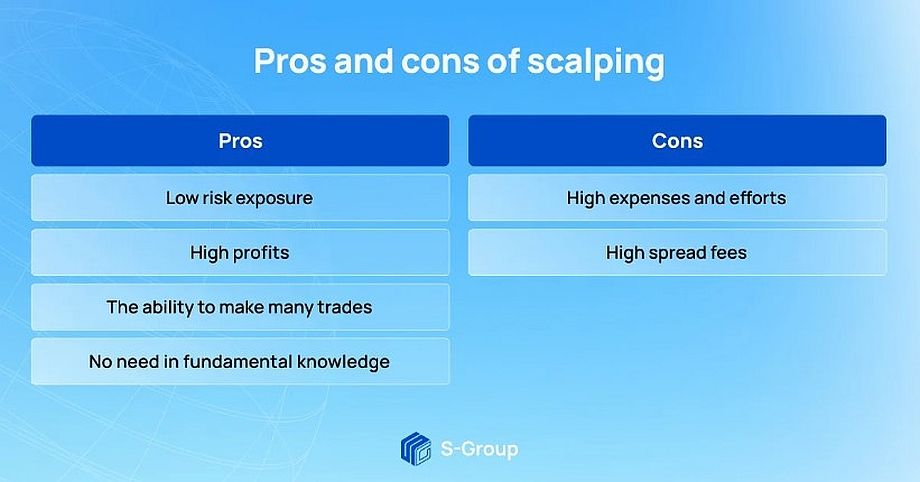

The success of trading largely depends on a deep understanding of all the nuances, pros, and cons of the strategy chosen by an investor. Scalping is not an exception. So let’s start with its main advantages.

– Lower exposure to risk due to short holding periods.

– Higher profits. Scalping has the potential for higher profits because it does not depend on large price movements in the market.

– The ability to make many trades. Scalping gives you the opportunity to take advantage of as many profitable trading opportunities as possible during any trading session.

– No need for fundamental knowledge. An investor does not need to have deep fundamental knowledge about a trading asset while scalping because trades are made during short periods of time and are based on technical analysis settings only.

Disadvantages of scalping

– Requires a lot of cost and effort. Scalping is a complex strategy that requires a lot of concentration as well as patience to repeat the same actions over and over again and to constantly monitor price movements.

– High spread fees. Scalping involves making many trades. This means that spread fees can be very high.

Top 4 rules of successful scalping

For successful scalping in the Forex market, it is important for an investor to consider and adhere to the following rules.

1. Risk management

Risk management is the basis of successful trading and loss minimization. If you like scalping strategy, you must not forget about market orders and possibility of taking leverage in order to minimize the risk of losses due to failed trades. Remember the main rule — do not trade with an amount greater than you can afford to lose.

2. A disciplined approach

A scalping strategy requires a careful approach to analyzing the market and monitoring the situation. Scalpers spend a lot of time at the computer screen and monitor any price movements, which requires both mental and physical endurance.

3. Selection of liquid pairs for trading

It is important to choose the most liquid currency pairs, such as EUR/USD, GBP/USD, USD/CHF and USD/JPY, when trading using scalping strategies. Due to the high liquidity of the chosen currency pair, you will be able to close the deal at any appropriate moment, as there will always be a buyer of the asset.

4. Trade at the busiest time

The most liquid time of the day on Forex market falls on the overlap of sessions — from 2:00 to 4:00 and from 8:00 to 12:00. Exactly during this time the strongest assets price movement is observed and scalper can use it to gain profit.

Is scalping strategy profitable?

Scalping in the forex market is an effective trading strategy, which can bring many profits. But it is important to understand that it is hard work because scalpers’ income depends on quantitative work. The more they work, the more potential profits they make.

You can use scalping as your main or additional trading style, adjusting to the market situation. The main thing to remember is that making trades requires attention, discipline, and speed. If you prefer to take your time to find the right asset and make a decision in time, then scalping is not your option. But if you like speed and want to make immediate profits — this strategy may suit you.