Fundamental VS Technical Analysis

Technical and fundamental analysis are the two main ways to forecast changes in financial markets and to choose an appropriate investment. For investing to be successful and profitable, it is important for investors to understand how these two types of analyses work and to find their own type of trading.

In this new article, we look at the definitions of fundamental VS technical analysis, their advantages, disadvantages and main differences.

Definition of Fundamental Analysis

Traditionally, fundamental analysis is used for stock valuation of companies. It means the study of economic data for the prediction of the asset’s price movement. Economic data includes analysis of the industry in which the company works, the company’s financial performance, its reputation, the amount of profit and loss.

Thus, fundamental analysis evaluates all the factors that may affect the value of a security, as well as helps determine the main trends and important factors affecting the market.

The fundamental type of analysis is used by investors who prefer long-term investing. In this case, the investor does not need to regularly monitor changes in the market and company performance, and most of the time is devoted to studying the economy at the time of buying the stock.

To conduct fundamental analysis, traders use economic calendars with important news events, analytical websites and reports by experienced analysts. These tools help to understand the situation on the market in details and make reasonable decisions concerning investments.

Fundamental VS Technical

Pros and cons of Fundamental Analysis

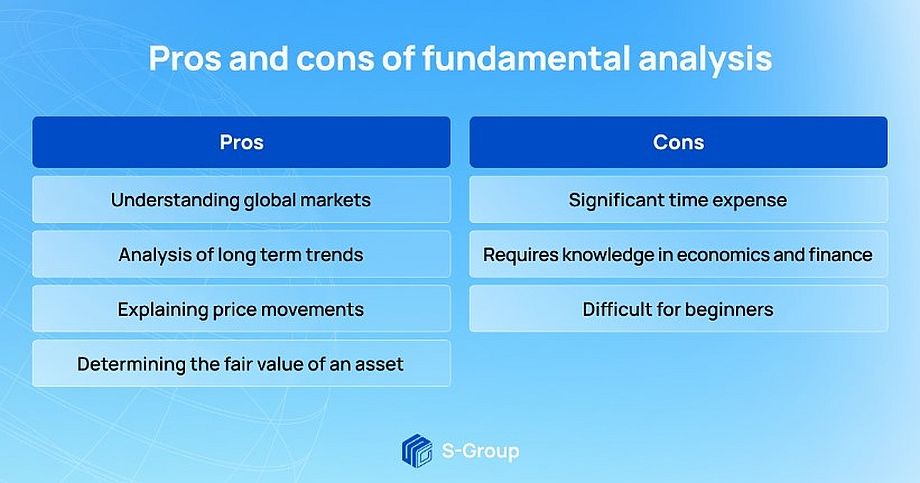

Let us study the main advantages of the fundamental analysis.

- Understanding of global markets. Using the fundamental analysis of stocks, the investor understands more deeply the economic condition of countries and world markets. As a result, it gives possibility to make a comprehensive assessment of the economic benefit of the asset purchase and its prospects in the long term.

- Long term trends analysis. The main goal of fundamental analysis is to determine the long term prospects of an asset by looking at several years of information.

- Explanation of price movements. Various economic news and events dramatically affect financial markets and asset prices. Understanding of fundamental analysis helps an investor to determine in what direction the price of an asset will change under certain events.

- Determining the fair value of an asset. Every asset has a fair price, which is determined not only by the economic condition of a particular country, but also by the financial condition of the company. Fundamental analysis of stocks helps an investor to do a thorough research and notice the discrepancy between the set price of an asset and its market value.

Despite the above advantages, fundamental analysis has the following disadvantages.

- Significant time expenditures. The qualitative fundamental analysis is a long and costly process that requires attentiveness and careful study of data from investor. It is very important to be able to concentrate in this process, in order to interpret the data correctly and make correct conclusions.

- You need knowledge in economics and finance. It is important not only to study the information and find it, but also to analyze it correctly in order to make the right investment decision. This requires the investor to have a deeper economic and financial knowledge.

- Difficult for beginners. Beginning investors or traders find it difficult at first to analyze events in the economy, understand their impact on the market, and relate them to technical charts.

Definition of Technical Analysis

Technical analysis involves studying asset price movements on charts to predict future changes. In financial markets, price movements are periodically repeated, and all changes can be tracked by standard patterns. For example, if the price goes sharply upward, then after a while, after reaching a certain point, it goes downward. Experienced traders analyze the charts and forecast the price movement based on the information.

Technical analysis is applied to various financial markets: currency, stock and cryptocurrency markets. When it comes to trading strategies, technical analysis of stocks or other assets is more suitable for short-term investing or trading, where the investor needs to predict the price of the asset for the near future.

When conducting technical analysis, it is important to proceed from three principles.

- Influence of price. Any influence of news or other informational factors is clearly shown on price charts. Therefore, all price changes are shown on the charts and can be tracked.

- Trends are logical. The price trend has a certain regularity, and the price of the asset is more likely to change according to this regularity than in a chaotic way. Most technical trading strategies are based on this assumption.

- History repeats itself. The tendency to repetition is associated with a predictable psychology of the market, driven by the emotions of fear and desire. Specialists analyze the connection between people’s emotional state and market movements and determine future trends. Some forms of technical analysis have been used for over 100 years, but are still relevant today because they show regularly recurring patterns of price movements.

Pros and cons of technical analysis

Let us consider the main advantages of using technical analysis.

- It takes less time than fundamental analysis. During the technical analysis, it is necessary to take into account and analyze only charts, which takes less time.

- Understanding the mood of the market. Charts quite clearly show the mood of the market in the first seconds of changes. Therefore, an investor can easily determine the level of supply and demand, as well as understand in which direction the price of the asset will move.

- Possibility to trade according to the algorithm. There are many trading robots on the market that can independently analyze charts and make investment decisions instead of the investor.

Minuses of using technical analysis of securities.

- Subjective data. Each trader can interpret the data from the chart in his own way, which makes the data subjective, and it is quite difficult to take into account the experience of other market participants.

- Non-disclosure of the causes of fluctuations. The trader sees on the chart only the fact of price changes, but it does not show why the value of the asset has changed and what it may lead to. Therefore, for a trader who chooses the technical analysis, it is important to know the basics of the fundamental analysis in order to determine the causes of price fluctuations. Fundamental VS Technical.

A comparative table of technical and fundamental analysis

Conclusions: which type of analysis to choose

Fundamental VS Technical

As we wrote above, the choice of the type of analysis depends on the investment strategy. If the investor prefers long-term investing, he should pay attention and study the basics of fundamental analysis. This type of analysis allows you to track the development of the company and the industry over the years, as well as determine the fair value of the asset.

If the investor is more attracted to trading, intraday trading, it is essential for him to understand how technical analysis works. Because it is technical analysis that gives the necessary data for short-term investments and makes it possible to predict trends. But it should be remembered that for the qualitative interpretation of data from the chart, it is also important for an investor to know the basics of fundamental analysis.