Hot VS Cold Crypto Wallets

A cryptocurrency wallet is a program or device with which you can store, send and receive cryptocurrency. We’ve already told you about custodial and non-custodial wallets, but today we’ll take a closer look at the next variety of crypto wallets — hot and cold.

What are hot and cold crypto wallets? What are the pros and cons of each type? How do they differ from each other?

Continue reading the article to find out the answers to these questions.

Hot cryptocurrency wallets

A hot crypto wallet is a mobile or browser-based app that has a constant connection to the internet. Such cryptocurrency wallets are easy to use, have a clear interface and functionality, making them a great option for users who are just starting their journey into cryptocurrency. In other words, it’s your everyday wallet that you can access at any time.

When a user signs up for a centralized cryptocurrency exchange, they also get a hot wallet that they can use at any time, as long as they have an internet connection.

Hot wallet users‘ funds are stored either on the wallet’s servers or directly on their computer. To ensure the security of users‘ assets, hot wallets have two-factor authentication for account logins and transactions, a multi-signature feature if the wallet is shared with other users, and KYC and AML authentication procedures.

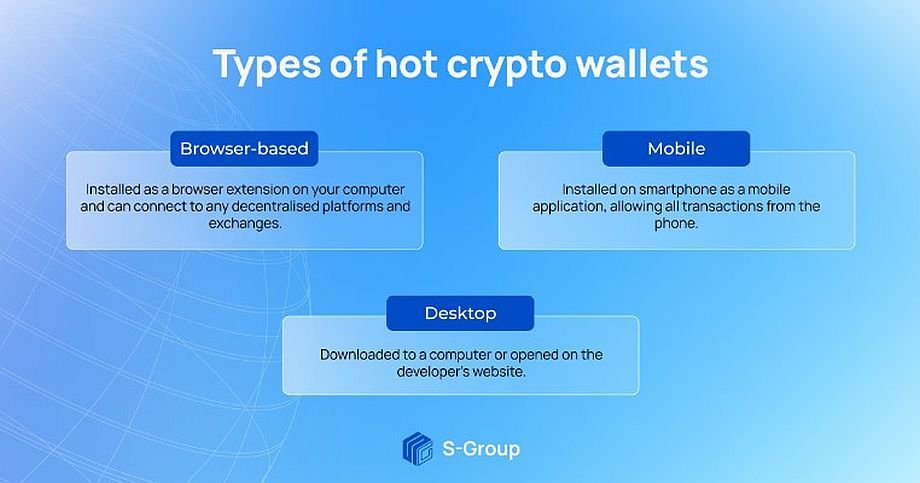

Types of hot cryptocurrency wallets

There are three types of hot crypto wallets: browser-based, mobile, and desktop. Let’s take a closer look at them.

– Browser crypto wallets

Installed as a browser extension on your computer, they can connect to any decentralized platforms and exchanges. Browser-based crypto wallets include MetaMask, Fantom, Polkadot.js, C98.

– Mobile crypto wallets

These cryptocurrency wallets can be installed on a smartphone as a mobile app and perform all transactions from your phone. Mobile cryptocurrencies include Trust Wallet, S-Wallet, SafePal.

– Desktop crypto-purses

These wallets can be downloaded to your computer, or you can use them on the crypto-wallet developer’s website. In other words, they are an alternative to mobile wallets, only on your computer. Typically, most desktop crypto wallets have a mobile version. For example, you can use S-Wallet crypto wallet from your smartphone as well as from your computer.

Advantages and disadvantages of hot crypto wallets

Let’s start with the main advantages.

- Ease of use and accessibility. To start using a hot crypto wallet, you just need to install an extension or app, go through a simple registration, remember your password and Seed phrase to regain access. After that, you can already start using the wallet.

- Support for many crypto-assets. Hot wallets support many tokens and coins, allowing you to interact with almost any asset.

- Hot crypto wallets are free of charge. There is no additional cost to install and download hot wallets.

- Fast operation. Making financial transactions in hot crypto wallets is fast, within a couple of minutes.

But despite all the advantages, hot wallets have a major disadvantage. It consists of lower security and vulnerability to hacker attacks due to storing assets on the wallet’s or computer’s servers. If attackers break into the wallet server or get the password to your account, your funds will be lost.

Conclusion. Experienced crypto investors advise using hot wallets for trading (buying and selling assets) as well as for storing small amounts of assets. This is a great option for those who care about ease of use and speed.

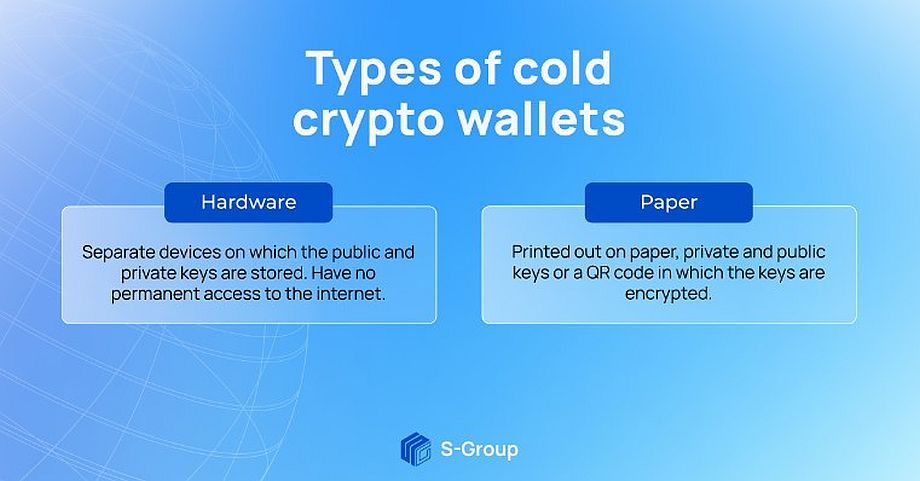

Cold crypto wallets

Cold crypto-wallets are crypto-wallets that are not connected to the internet. They are more secure than hot wallets, as it is impossible to access such a wallet.

There are two types of cold crypto wallets.

– Hardware crypto wallets

These are separate devices on which the public and private keys are stored. They do not have access to the internet permanently, they only connect to the network for a couple of minutes when the user turns on the wallet and makes financial transactions. An analogy can be drawn with an external computer hard drive or flash drive. Transactions with such a wallet are difficult to perform, so these devices are used for long-term storage of cryptocurrency.

– Paper crypto wallets

Printed on paper, private and public keys, or a QR code in which these keys are encrypted. To access the wallet, you will need to either enter the keys manually or scan the QR code. The main disadvantage of such a wallet is the short-lived nature of the paper, as it can easily get corrupted or lost.

Advantages and disadvantages of cold crypto wallets

Let’s start with the advantages.

- High security. Cold crypto wallets store assets offline. Consequently, hackers and attackers will not be able to hack into a cold wallet and gain access to your assets.

- Full control over your funds. Wallet functionality does not depend on third parties, i.e. the risk of losing funds due to company closure or not having access to assets due to technical works is gone.

- Possibility to create a backup copy. Owners of cold crypto wallets get the opportunity to back up the wallet and restore access to it.

Of the disadvantages, the following can be highlighted.

- Less convenient to use. Due to lack of network connection, it will take some time for the user to connect the device to the computer in order to start working with the assets. In addition, they are more difficult to use for inexperienced users.

- Limited functionality. Cold wallets support fewer crypto-assets and are not suitable for fast trading.

- Cold wallets are fee-based. To start using a hardware wallet, the user will need to buy one and spend a lot of money.

Conclusion. Cold wallets are the best option for storing large amounts of crypto-assets that do not need constant access and long-term investment. In addition, they are more suitable for experienced users due to the complexity of the functionality.

Comparison of cold and hot cryptocurrencies

To summarize the information above, here is a comparison table of hot and cold cryptocurrencies.

Hot or cold wallet: which one to choose?

Each of these wallets has its own purpose. To better understand, we can draw an analogy with a regular wallet that you use every day (hot wallet) and a safe where you keep your savings (cold wallet). In life, you can use both the wallet and the safe. You can do the same thing with cryptocurrencies.

Hot wallets should be used for storing small amounts of assets and making money through trading or staking.

Cold ones to use for long-term investing and storing large amounts of cryptocurrency, which should be in as safe a place as possible.