KYC & AML in cryptocurrency

Over the past few years, cryptocurrencies have gained a foothold in the global economy. Blockchain technology allows financial transactions to be made confidentially and anonymously, which has led criminals to use cryptocurrency to launder vast sums of illegally obtained funds. Thus KYC & AML in cryptocurrency comes into play.

KYC and AML identification procedures are used by cryptocurrency exchanges to verify customers and combat financial crime.

What are KYC and AML procedures, and why are they needed in the crypto world? We answer these and other questions below.

What is KYC, and how does the procedure work?

When registering on any centralized exchange, it is mandatory to pass the KYC procedure, without which financial transactions will not be available. KYC stands for “Know Your Customer”. Under KYC, the exchange asks the user for information that confirms his identity. In order to successfully pass the verification, the user needs to provide:

– Passport or driving license.

– Specify the country and place of residence.

– Specify an email and phone number.

However, just to specify the data is not enough, for successful verification you will need to provide proof of specified data. That is, take a selfie with your passport or driving license, enter a code that will come to your phone number, send copies of utility bills to confirm your place of residence, bank statements or rental agreement.

Most crypto exchanges use a tiered KYC identification tier system, whereby the user has to provide more information in order to allow access to use large amounts of assets.

Crypto-exchanges‘ KYC terms usually fall into one of three categories.

1. No KYC. The exchange allows a new user to open an account without any identification, but the functionality of the account will be limited. For example, without the ability to withdraw funds.

2. Basic KYC. User provides an ID and a photo. The functionality of the account is limited to a fixed small limit for deposits and withdrawals.

3. Full KYC. Users who want to deposit, withdraw, withdraw large amounts of cryptocurrency must undergo full KYC verification.

How does KYC verification work on cryptocurrency exchanges?

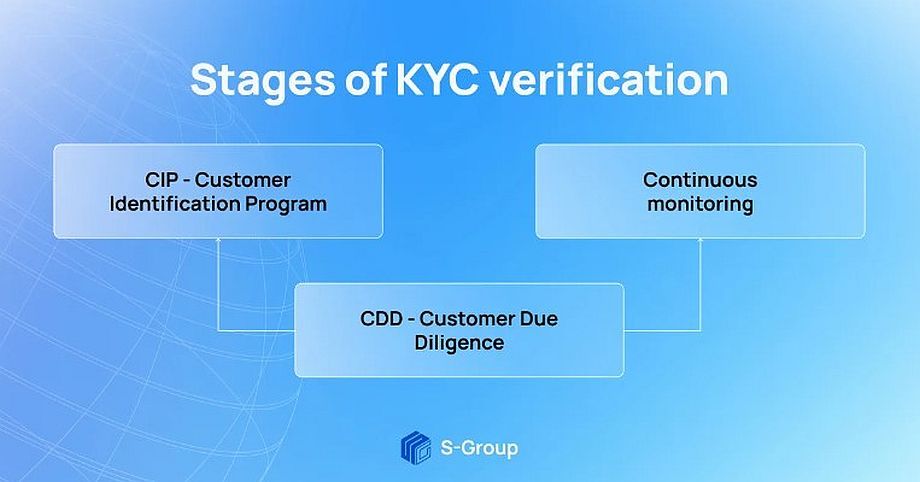

Generally, there are three parts to customer identification.

- CIP (Customer Identification Program). The first part of KYC, which is to collect and verify personal information of customers provided during or after registration.

- CDD (Customer Due Diligence). At this stage, the client’s background is checked in order to assess risks. If there are any cases of financial fraud or criminal investigations in the client’s biography, it will be revealed. It is this data that will determine the degree of control of the account.

- Continuous monitoring. Refers to the constant checking of user transactions for criminal activity. The system checks large transactions to countries that are involved in terrorism, etc., and if a problem is detected, the data is passed on to law enforcement agencies.

Why KYC in cryptocurrency?

The blockchain network is transparent and allows users to trace the history of any cryptocurrency transaction. But since the blockchain network only displays the wallet address, it is not possible to identify the owner. Consequently, it is also impossible to know the reason for receiving or transferring funds. And the reason for transferring funds could be terrorist sponsorship, ransom for kidnapping, phishing, etc.

It is to detect such unlawful activities that KYC identification is needed to ensure the security of transactions on the platform.

By implementing KYC procedures, cryptocurrency companies can gain the trust of users and regulators without sacrificing their profits. When cryptocurrency exchange Binance made KYC mandatory for all its customers, it found that 96-97% of users pass KYC during registration. This small reduction in registrations is a small price to pay for the ability to operate in hundreds of regulatory environments, serve millions of customers and crack down on illegal activity of all kinds.

AML: what is it, why is it needed, and how is it different from KYC?

AML (Anti-Money Laundering) refers to the fight against the illicit trafficking of funds. At first glance, it may seem that AML and KYC are the same procedure, but that is not entirely true. The fact is that KYC is only part of the full-fledged anti-money laundering program that is AML. Let’s take the analogy with the customs check as an example. KYC is a document check only, while AML is a check of the contents of all luggage.

AML is a comprehensive review of users‘ online behavior that may be considered suspicious. For example, transfers of large amounts, multiple deposits into an account, dispersal of a large amount into different accounts, etc.

How do crypto-exchanges monitor the process of illicit fund turnover using AML?

The process of tracking suspicious transactions takes place in three stages.

- Suspicious activity detection. Users‘ accounts are automatically checked for large deposits or withdrawals. We also check for low-active accounts which have a sudden increase in withdrawal activity.

- Suspension of the ability to deposit and withdraw funds. If an exchange detects a suspicious account, the owner of that account is blocked from depositing and withdrawing funds for the duration of the investigation. The exchange then collects data in a suspicious activity report.

- Transmission of data to law enforcement authorities. When evidence of illegal financial activity is gathered, the data is transmitted to law enforcement authorities.

Pros and cons of KYC & AML in cryptocurrency

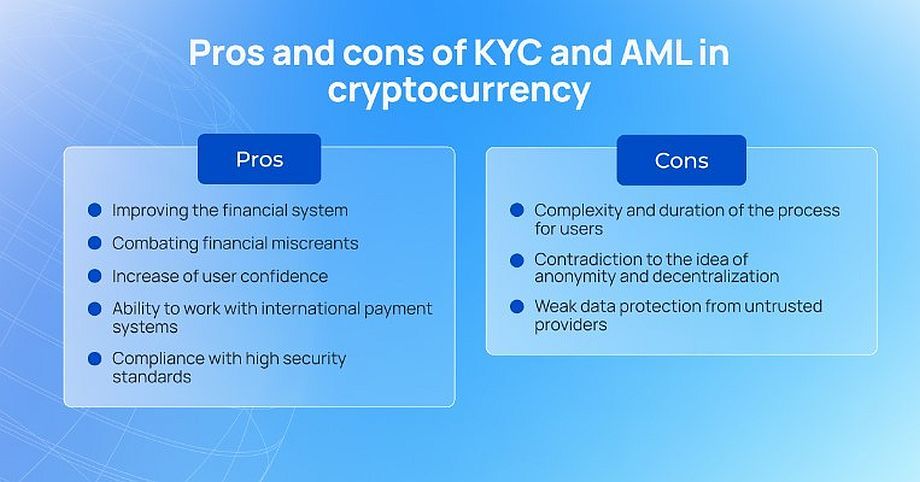

A large number of users use the fact that conducting such procedures contradicts the traditional idea of cryptocurrencies — anonymity and decentralization — as the main argument “against”.

In addition, some users find it difficult to go through KYC procedures due to the lack of necessary documents or a fixed residence address.

And the last argument “against” is the weak protection of users‘ personal data at unreliable exchanges. In such a case, if an exchange is hacked, not only the users‘ funds but also their personal data will suffer.

But despite the disadvantages above, there are still more advantages to conducting KYC and AML.

Firstly, this practice helps to combat financial miscreants and improve the financial system.

Secondly, KYC and AML increase user confidence in crypto exchanges and give a sense of security because you understand that there are no fraudsters and all trades are legitimate.

Third, if an exchange supports KYC and AML, international payment systems such as Visa and Mastercard can work with it.

Fourth, the effective use of KYC and AML helps crypto exchanges to replace outdated verification systems and ensure full compliance with security standards.

Key takeaways

Customers of cryptocurrency exchanges that use KYC and AML verification procedures not only get the ability to withdraw and deposit funds quickly, but also the assurance that the platform is legitimate and secure.

AML and KYC cannot be called a breach of anonymity, as it guarantees the safety of users in making transactions on the platform. So by using the functionality of the platform, you will be confident that trading on the exchange is safe, you won’t be scammed, and you can always regain access to your funds or account.