Crypto exchanges: centralized vs decentralized

Cryptocurrency exchanges have been used since the world’s first cryptocurrency, Bitcoin, until today as a channel of communication between the buyer and seller of assets. This is the place where you can buy and sell cryptocurrency.

There are two types of crypto exchanges: centralized and decentralized. In this article, we explain what centralized and decentralized exchanges are, discuss their advantages and disadvantages, as well as the key differences.

Centralized cryptocurrency exchanges: pros and cons

Before explaining what a centralized exchange is, let’s understand the general concept of centralization.

Centralization means that there is a hierarchy in the network. There is one master computer, user or system that holds most of the data or has more rights.

If we talk about an exchange, it means that a centralized exchange (CEX) is an online platform that stores users‘ assets and data on its wallets and servers. It is operated by one central authority, which acts as a security guarantor and is fully responsible for the operation of the platform.

All centralized crypto exchanges are regulated by financial authorities and operate under KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

To start trading on a centralized exchange, the user needs to register, go through the KYC verification process, and then fund their account balance. After that, the user can start trading the cryptocurrency that suits them.

Some of the best known centralized cryptocurrency exchanges are: Binance, Coinbase, Qmall, ByBit, Kraken, Kucoin.

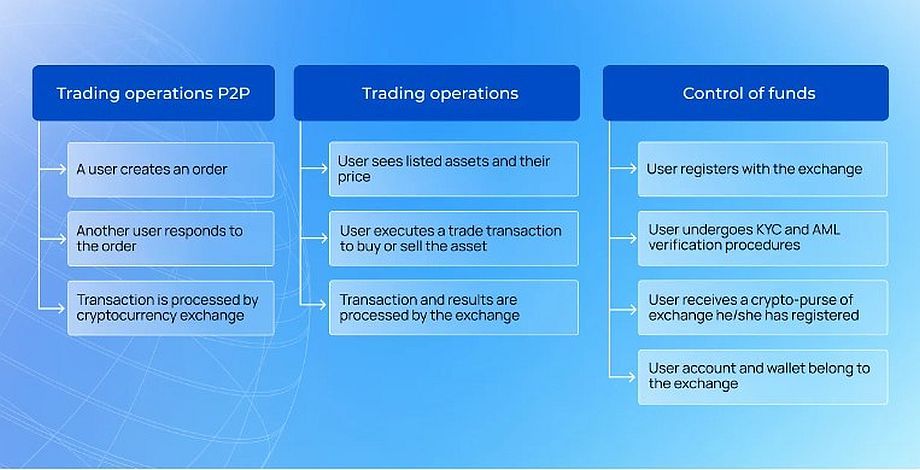

Schematically, the work of a centralized exchange can be depicted as follows:

Pros of centralized crypto-exchanges

1. Intuitive interface. Centralized crypto exchanges are designed with a clear interface that can be easily understood even by a beginner.

2. Additional trading tools. On centralized crypto exchanges, users have the opportunity to earn additional income through:

– futures trading;

– margin trading;

– trading with orders;

– leveraged trading.

3. High liquidity. Centralized exchanges have a larger number of users registered and therefore tend to have higher liquidity.

4. Protection against scam projects. Centralized exchanges have high listing requirements for coins. So if a coin is listed on a popular centralized exchange, you can rest assured that it is safe because it has gone through maximum scrutiny by the exchange’s team.

5. Minimal commissions. Transactions on centralized crypto exchanges are done with minimal fees.

6. Availability of technical support. If you have any problems with accessing your account or any question about the platform, you can contact the technical support and get a prompt answer.

Cons of centralized crypto exchanges

1. The exchange has access to user funds. One of the main disadvantages of centralized cryptocurrency exchanges. Even though you can withdraw funds from the exchange at any time, there is no 100% guarantee that the exchange will not close or go bankrupt.

2. The risk of hacking and hacking attacks. Because all user funds are stored on a single exchange server, the risk of hacking and loss of assets is quite high. Popular exchanges minimize this risk, but it cannot be completely eliminated.

3. Lack of complete anonymity. Every user of a centralized exchange has to go through a KYC identification procedure. On the one hand — it is a guarantee of security, but on the other hand — deanonymization. Many users don’t want to reveal their identity so that no one can trace his financial transactions or use confidential data.

Decentralized cryptocurrency exchanges: pros and cons

If the notion of centralization means the presence of hierarchy and data storage in one registry/system, the opposite is the case with decentralization.

Decentralization is the absence of hierarchy. In this case, all data is stored simultaneously by all users of the system without a single server.

Thus, a decentralized exchange (DEX) is a platform that does not require a third party to execute transactions. Users trade directly with each other, and the security and assurance of terms and conditions are guaranteed by smart contracts.

There is no need to register or verify your identity to start using the decentralized exchange. All you need to do is connect a browser-based wallet that supports the blockchain you want. For example, you can connect a MetaMask wallet to one of the most popular exchanges, PancakeSwap. After that, all the transactions you make on the platform will go through your wallet.

Trading on decentralized exchanges takes place using currency pairs, e.g. USDT/SWP. That is, to get SWP on PankcakeSwap, you need to exchange USDT, which are in your wallet balance. By doing so, you not only exchange your asset, but also increase the liquidity of the currency pair.

In addition to exchanging, you can earn on decentralized exchanges through staking, farming or liquidity mining. With all of these methods, you provide liquidity to the liquid currency pair you are interested in, in return for which you receive interest.

The basic operation of a decentralized exchange can be shown as follows

Pros of decentralized crypto exchanges

1. Complete anonymity. To start working with a decentralised exchange, there is no need to leave any data, as there is no registration or verification procedures.

2. Your funds are held only by you. A purse and an account on the decentralized exchange belongs exclusively to the user. That is, you do not create a crypto-purse on the exchange itself, but add your own.

3. There is no single control center. Users can not worry about exchanger to close due to new law or to limit work with assets, because there is no common control center.

4. Minimal risk of hacking and hacking attacks. Due to the fact that the assets are stored only by the user and even the exchange does not have access to them, hacking and hacking becomes impossible.

5. Lack of limits and restrictions. Decentralized exchanges have no limits on trading, entering or withdrawing funds, and no geographical restrictions. In addition, no one can limit the operation and performance of the platform.

Cons of decentralized crypto exchanges

1. Lack of trading tools. There is no futures trading or order trading on a decentralized exchange, with which one can buy or sell an asset automatically when the right price is reached.

2. Complex functionality. To understand the operation of a decentralized exchange for a user who has just entered the world of cryptocurrencies is more complicated. You need to have a lot of technical knowledge.

3. Security — responsibility of the user. When using decentralized exchanges, it is important to understand that the security of the wallet and assets falls on the user’s shoulders. In case the key is lost or data is stolen, no one can help.

4. Lower liquidity. Due to smaller number of users, DEX exchanges have poor liquidity, especially in unpopular cryptocurrency pairs.

The main differences between centralized and decentralized cryptocurrency exchanges

We will compare centralized and decentralized exchanges based on the following parameters:

– main characteristics;

– security;

– regulation;

– control of assets;

– liquidity.

Main characteristics

Centralized exchanges are faster and easier to use. These platforms have a simple and straightforward interface and are easy to register and start trading on. Users have a variety of options for depositing and withdrawing funds via bank cards or wire transfers.

Decentralized exchanges are more complex and require additional expertise for trading.

Security

Centralized exchanges are more susceptible to hacking and data breaches than decentralized exchanges. To get into the system, hackers need to bypass the company’s security and then gain access to user assets, financial information and other data.

Decentralized exchanges are nearly impossible to hack because hackers would have to attack each user individually. Decentralized exchanges can attack individual smart contracts, but not the company as a whole.

Bottom line: while both CEX and DEX exchanges can be attacked, the risk of hacking and asset loss on DEX is much lower.

Asset control

Centralized exchanges hold the assets of their users. This means that users rely on the exchange to fulfil its obligations. On CEX, you have no control over your private key, so the exchange can confiscate them at any time. In other words, a centralized exchange works like a bank, which in the same way can close/bankrupt or limit access to assets at any time.

With a decentralized exchange, only you have access to your private key and assets. Consequently, the exchange cannot restrict your access to your wallet and funds.

Bottom line: on centralized exchanges the platform has complete control over the user’s funds, on decentralized exchanges the user manages and controls the assets.

Regulation

Centralized exchanges are regulated by law and must comply with KYC and AML standards to prevent money laundering and terrorist group funding. Some CEXs have a less stringent KYC procedure, but absolutely all centralized exchanges require users to undergo it.

Decentralized exchanges are not regulated, and all transactions are processed on accessible blockchains. DEX do not act as financial intermediaries, but only provide the infrastructure in the form of smart contracts.

Bottom line: centralized exchanges are regulated and users must pass AML and KYC to trade. Decentralized exchanges are not regulated.

Liquidity

Centralized exchanges have much higher liquidity and allow traders to trade tens or hundreds of millions of dollars in the most liquid cryptocurrencies.

Decentralized exchanges have lower liquidity. This leads to slippage, where large orders can only be executed at worse prices than traders expect. Thus, traders may incur higher costs on DEX if they want to trade significant amounts.

Bottom line: CEX is much more liquid, on DEX you may experience slippage if you trade large amounts.

Which exchange to choose?

Choosing a cryptocurrency exchange depends on the personal preference of the crypto investor. While many users prefer centralized crypto exchanges because of their security, speed, ease of use, other crypto enthusiasts choose decentralized crypto exchanges because of complete anonymity, asset control and minimal hacking risks.

The choice of exchange should be made depending on your experience and the transactions you want to conduct there.

Centralized crypto exchanges are a great option for those who are just starting their journey into cryptocurrency, value security, want to use trading tools, and have the ability to recover access to funds if their data is lost.

Decentralized exchanges are suitable for those who are already somewhat familiar with the cryptocurrency industry and value complete anonymity and no risk of hacking.

You can use both types of exchanges, but be careful about the security and precautions on each one.