What is spot trading on the crypto market?

The way to invest in cryptocurrency depends on the choice of trading strategy, the size of the investor’s initial capital and the investor’s level of risk tolerance. One of the main ways to trade cryptocurrency is spot trading.

What is spot trading? How and where is it executed? What are the advantages and disadvantages of spot trading? Learn the answers to these questions in this article.

Spot trading: definition and key terms

Spot trading is a way of buying and selling cryptocurrencies with instant payment and transfer to the buyer (on the spot). This type of trading is popular among beginner traders because it is easy to understand and implement.

Spot trading is suitable both for day trading and long-term investments, because the trader physically owns the digital asset and can keep it on the balance indefinitely. The specific feature of spot trading is that the trader buys the asset with his own funds, without using the leverage of a broker or a crypto exchange.

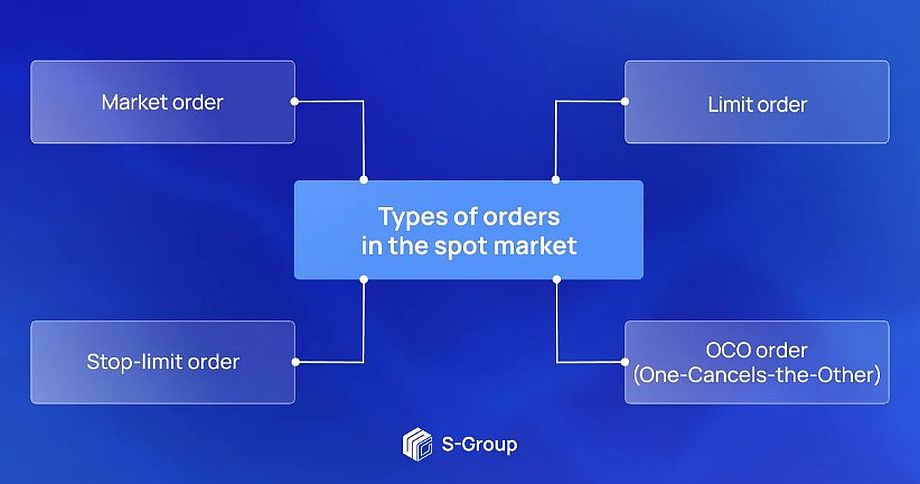

Several types of orders are available for trading on the spot market.

– Market order. Allows instant buying and selling of cryptocurrency at the current market price. The execution speed of market orders depends on the liquidity of the spot market where the trader is trading.

– Limit order. A transaction to buy or sell an asset is made when its price reaches a set limit. A trader can create a buy order by setting a limit lower than the current market price and a sell order by setting a limit higher than the current market price.

– Stop-limit order. Consists of a stop price and a limit price. The stop price indicates the value of the asset, at achievement of which the order for its buying or selling with the set limit price is automatically placed.

– OCO order (One-Cancels-the-Other). Combines a limit and a stop-limit order. The partial or complete execution of one of the orders automatically cancels the other. Both orders must be for buy or for sell.

Where spot trading is available

Spot trading of cryptocurrency is available on centralized (CEX) and decentralized (DEX) exchanges, as well as over-the-counter (OTC) markets.

1. Centralized exchanges act as intermediaries between buyers and sellers. Trading on CEX, a trader needs to fund an exchange account with fiat or cryptocurrency and place an order to buy or sell an asset in the order book. Centralized exchanges provide fair pricing, adherence to transaction terms, and user account protection.

Exchange algorithms match orders to buy and sell cryptocurrencies that match price and amount. If there is no exact match in terms of amount, the order can be executed in several stages and at different prices.

2. Decentralized exchanges may also use an order book model or automatic market makers (AMMs), but transactions are made automatically and without intermediaries, using smart contracts. By trading on DEX, a trader may not have to fund an account, as assets are transferred directly between the crypto wallets of buyers and sellers.

Centralized and decentralized exchanges are characterized by high liquidity, but sometimes it is not enough to avoid slippage. Therefore, orders with high volume may take longer to execute or partially at an unfavorable price.

3. Spot trading in OTC markets is trading directly between brokers, traders and dealers without intermediaries and order books. This trading channel allows large volume transactions at a better price, avoiding slippage. OTC trading is popular even for highly liquid cryptocurrencies such as Bitcoin.

Advantages and disadvantages of spot trading

Before starting to trade cryptocurrency on the spot market, an investor should evaluate all the advantages and risks of this trading method. This will help to understand if this trading method fits his or her trading strategy, financial goals and desired level of risk.

Let’s look at the main advantages of spot trading.

1. Possession of an asset. When an investor buys a cryptocurrency on the spot market, he becomes its physical owner. He can use additional features, such as staking and mining, to increase his return on investment.

2. Reducing risks. When trading on the spot market, the trader can lose only the assets, which he has already invested. The lack of leverage in trading greatly reduces the risks and allows the trader to wait indefinitely for the growth of the asset price.

3. Price formation. Spot prices of assets are transparent, because they are formed only on the basis of supply and demand on the market. The trader can always buy or sell the asset based on the current market price.

There are also disadvantages of spot trading.

1. Low profitability potential. Lack of leverage not only reduces risks, but also limits the potential income from investments. By trading on futures and margin markets, an investor can increase his income significantly in a short period of time, which is not possible on the spot market.

2. Loss-making assets. Many cryptocurrencies continue to grow and increase their capitalization over the years, but there is a risk of choosing a digital asset to invest in that will not grow in value. In this case, the investor will not make a profit or even lose the invested funds.

Conclusion

Spot trading is based on simple principles and models, which makes it popular among beginner investors and those who want to minimize investment risks. Despite the clear process of spot trading, investors need to prepare carefully: study the market, choose a promising cryptocurrency, assess their potential opportunities and financial goals.

An investor should not forget about risk management, because cryptocurrency is a very volatile instrument, and investments in it also remain high-risk in this trading method.