What are liquidity pools

In order for DeFi platforms to trade and conduct economic activity, they must have a stock of assets. If banks and centralized exchanges are responsible for the accumulation of assets in traditional finance, then in DeFi this task is performed by the technology of liquidity pools. What are liquidity pools, how do they work, and what role do they play in the DeFi system? Keep reading the article to find out the answers to these questions.

What is a liquidity pool?

A liquidity pool is an accumulation of digital assets on a DeFi platform that creates liquidity for trading on crypto exchanges. The assets in the liquidity pool are provided by platform users (liquidity providers) and are frozen in smart contracts. This allows operations within the pool to be performed automatically and without intermediaries.

The liquidity pools consist of currency pairs. Each currency pair has its own liquidity pool, for example, DOT/USDT. The prices of currencies relative to each other are regulated by the protocol of automated market makers (AMM). This is the part of the code that maintains the liquidity balance using mathematical formulas. For example, if a trader buys a DOT token in the DOT/USDT pool, the amount of this token in the pool decreases and its price rises.

A trader who trades currencies in a pool does it without the participation of other platform users. He makes financial transactions using AMM directly with the system in which the assets of liquidity providers are frozen. The more user assets are placed in the pool, the higher its liquidity.

High pool liquidity allows a trader to complete transactions faster, as there is enough currency in the pool to meet demand. This means that the currency in such a pool can be bought or sold at any time.

Low pool liquidity increases transaction times and the risk of slippage. Slippage occurs when, due to the long duration of the transaction, the total amount of the transaction does not match the one that the trader expected.

Liquidity Pools – Opportunities for Investors

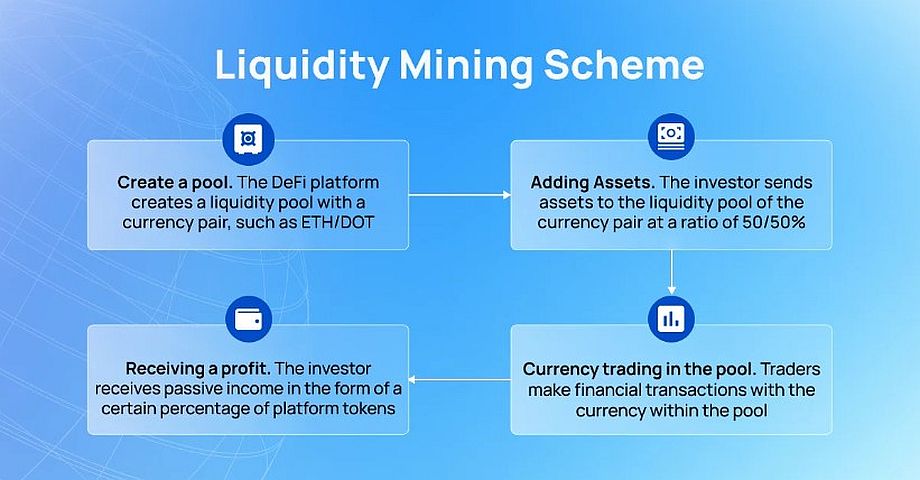

Decentralized platforms with liquidity pools provide an opportunity to earn money by sending your own assets to the pool. This method of investing is called Liquidity Mining.

The essence of the liquidity mining operation is as follows. The user selects a suitable currency pair pool and creates a deposit for the amount that he is ready to give to support liquidity.

A deposit is created for a certain period, after which the user receives a percentage of the profit for providing funds. The investor’s profit may consist of a percentage of transaction fees and platform tokens. The amount of interest depends on the project that the user has chosen for investment. For example, on the PancakeSwap platform, you can select a pool with an estimated annual return of 2% to 110%.

Liquidity providers generally receive platform tokens in proportion to their contribution to the pool’s liquidity. If the provider wants to return the assets he added to the pool, his tokens will be burned.

To become a liquidity provider, a user must take several steps:

1) Choose a decentralized platform that supports liquidity pools and check its reliability: view White Paper, research social media, evaluate audience loyalty to the platform.

2) Select a liquidity pool with the currency pair of interest. Both currencies must be in the user’s crypto wallet. If one of the currencies is a stablecoin, the provider reduces the risk of partial loss of funds on volatility.

3) Add both currencies to the pool at a ratio of 50 to 50%. That is, if an investor wants to invest in the ETH/DOT (Ethereum/Polkadot) pool currency pair in the amount of $2,000, he needs to deposit $1,000 in ETH and $1,000 in DOT.

4) Upon the expiration of the created deposit, receive a reward for replenishing the liquidity pool, the amount of which is provided for by the selected platform.

Benefits of investing in liquidity pools

1) Simplicity of the process. Investments in this direction are similar to a deposit in a bank. The investor provides his assets to the platform and receives a percentage of the profit for their use.

2) Transparency. Thanks to smart contracts, the process happens automatically. Therefore, both the platform and the user comply with the conditions specified in the code.

3) Low entry barrier. Most platforms allow you to deposit a small amount of assets into the pool. Over time, an investor can increase their return on investment with compound interest – reinvest income from liquidity mining and earn higher returns in the future.

Risks of investing in liquidity pools

1) Impermanent losses. The risk of a decrease in the value of an investor’s assets in the liquidity pool due to the volatility of cryptocurrencies.

2) Platform incompetence. If the platform hosting the liquidity pool does not have a trading strategy or its smart contracts are vulnerable, the investor may lose their assets. To avoid this, you should carefully research the platform before investing.

Summary

Liquidity pools have also become an effective passive income tool for crypto investors. Decentralized platforms are developing new reward mechanisms to attract more liquidity providers and create sustainable financial markets. This makes liquidity pools a promising area for investment.