Forex simple and compound interest

Forex trading is one of the most popular tools for making a profit in the field of asset trading. It requires deep analysis and proper risk assessment. Traders start learning to trade on Forex with small deposits, gradually increasing them. Over time, capital is built up using simple or compound interest.

What is forex simple and compound interest? What formulas are used to calculate them? How to increase capital using compound interest? Look for answers to these questions in the article.

What is forex simple and compound interest

Simple interest is a profit percentage of the initial investment. With this method of accruing interest, the investor receives a payment at a rate and immediately withdraws it. In the next period of accrual of the rate, the percentage of profit is calculated from the same amount as in the previous one – from the body of the deposit.

Consider the example of a bank deposit where an investor deposits $1,000 at an annual rate of 8%. At the end of the period (in a year), the investor receives a profit of $80, which is immediately withdrawn to an external account. The body of the deposit remains unchanged – $1000. In a year, another $80 will be credited to him. After 10 years, the total capital of the investor will be $1,800, $800 of which is a simple percentage of a bank deposit. The deposit amount will remain unchanged.

With the simple interest method, income grows linearly and predictably. The formula for calculating simple interest looks like this:

Compound interest is the percentage of profit that is accrued both on the body of the deposit and on the interest accrued for previous payment periods. Compound interest is also called reinvestment or capitalization. Compound interest increases the body of the deposit and the amount of profit after each payment.

Consider the example of the same bank deposit of $1,000 with an annual rate of 8%. At the end of the first year, the investor’s profit will be the same – $80. But in the compound interest method, it is not withdrawn, but added to the body of the deposit. At the end of the next year, the investor’s profit will already be $166.4. After 10 years, the total amount of his capital will be $2158.93. That is, the profit will increase by more than 2 times.

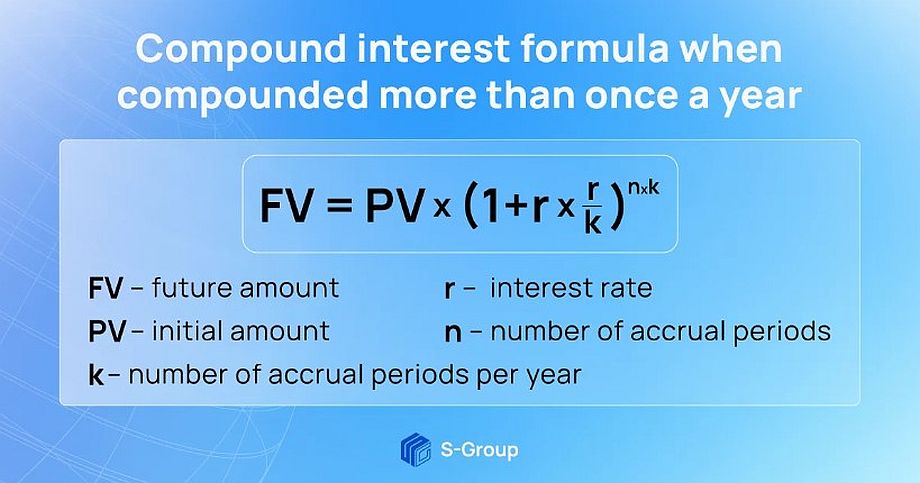

Compound interest is calculated using the following formula:

Special sites with calculators have been developed for quick calculation of compound interest: The Calculator Site, CashbackForex, Compound Daily.

For short periods of time, the difference between simple and compound interest will be small. If you increase at least one of the variables in the compound interest formula, the difference becomes noticeable. Formula variables can be:

– the value of the interest rate;

– the number of accrual periods per year (the more often the rate is paid, the higher the total profit);

– the duration of the investment.

The comparative line graph of simple and compound interest shows the difference between them in different time intervals.

Forex Compound Interest: Opportunities and Benefits

Forex trading with the compound interest method helps to increase the size of the deposit several times over in a short period of time.

Receiving income from the transaction, the trader does not withdraw it, but adds it to the deposit. In the next trade, he will be able to buy more contracts at the same price and earn a larger profit at the same interest rate. With each new transaction, the trader’s deposit will grow, which gives him the opportunity to trade a larger number of instruments.

Main Benefits of Compound Interest:

– Capital growth rate. The compound interest graph is growing exponentially.

– Management of risks. By reinvesting his income, the trader analyzes transactions more carefully.

– The ability to capitalize profits without attracting additional finance.

Disadvantages of the compound interest trading strategy:

1) When reinvesting trading income, there is a risk of losing the deposit along with the profit after an unsuccessful transaction. To avoid this, traders are advised to properly manage risk while trading.

2) The trader may not feel the profit from trading, as he does not convert it into real money and can’t spend it. Traders who care about tracking physical income practice withdrawing at least 30% of the total profit.

If the investor replenishes the deposit daily or monthly with small amounts, he receives additional charges for compound interest. In this case, the income will constantly grow even with a minimum initial deposit of $100.

Summary

The compound interest method effectively increases capital and allows investors to expand their investment portfolios. The effect of this method depends on the frequency of profits reinvestment and the interest rate at which they are charged. The simple interest method also brings profit to the trader. But in this case, the profit increases only in proportion to the interest rate.

In the direction of S-Forex, partners regularly receive accruals on simple and compound interest. For 2022, the profit on simple interest was 115.20%, and on compound interest – 200.23%. Thus, S-Group partners doubled their income in a year using the compound interest trading strategy.