DeFi: what it is and how it works

In 2021, DeFi (Decentralized Finance) grew by, 1210% from $18.71 billion to $245.22 billion, which means more, and more people are entrusting their assets to decentralized finance and even making money from it.

What DeFi is, how the sphere works, its advantages and disadvantages — keep reading to learn all about decentralized finance.

Decentralized finance: definition and workflow

DeFi is a decentralized finance technology that acts as an alternative to centralized institutions like banks or exchanges. DeFi allows the creation of different applications, services that allow users to store assets, as well as passive income in a variety of ways.

DeFi’s main goal is to give users access to investment platforms and lending without the involvement of centralized intermediaries. Moreover, decentralized finance solves the problems of the traditional banking system. Namely, intermediation and insufficient security.

For example, if a person wants to take a loan from a bank, they can be refused without even explaining the reason. In DeFi, a loan service can be used by anyone in a matter of minutes without the need to provide various documents.

Another example, keeping your money in the banks, you fully rely on this structure and trust them to keep your assets. But as practice shows, cases of bankruptcy of banks or their bad faith are quite common. So there is a risk of losing your savings temporarily or permanently.

How does DeFi work?

Users interact with DeFi via dApps (decentralized applications) that run on blockchain. Typically, most decentralized applications are built on the Ethereum blockchain using smart contracts.

Blockchain technology makes DeFi-platforms transparent because all information is transparent and available to all users through open source. And smart contracts eliminate the risk of manipulation associated with the human factor, as all conditions are prescribed in an algorithm that cannot be faked or changed.

Thus, on DeFi-platforms users can securely and directly make transactions with each other without intermediaries, get quick access to financial services and receive passive income.

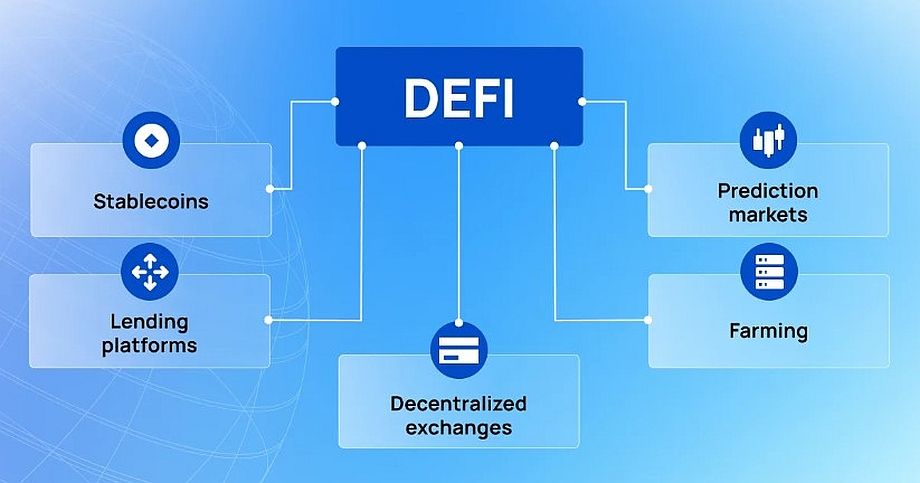

Examples of DeFi applications

DeFi’s main goal is to create a decentralized alternative to all the financial services that are now available in the centralized sphere. Let’s take a look at the main DeFi applications.

Decentralized Finance-stablecoins

The creation of stablecoins was one of the first applications of the field of decentralized finance. They are used for trading, borrowing, lending, and provide protection against high market volatility through a stable exchange rate.

For example, if a user creates a crypto-deposit on a DeFi-platform in Ethereum coins, he has the risk of losing profits due to a sharp fall of the cryptocurrency. To protect themselves from such risk, cryptoinvestors use Stablecoins. In this case, the value of the underlying asset will no longer depend on the volatility of the cryptocurrency market, because the rate of stablecoins is tied to the dollar rate 1:1.

Lending platforms

Lending platforms are the most popular DeFi services, which allow users to lend and borrow funds without intermediaries and any documents. Such platforms work as follows.

- Lenders and borrowers register on the platform

- Lender creates a deposit

- Funds are transferred to Lending Platform

- Borrower transfers assets to the deposit

- Lending Platform charges funds to borrower

- After use, borrower returns funds

- Lending Platform returns assets to borrower

- Lending Platform credits the funds and income to the lender

A smart contract is used to guarantee that the terms and conditions are fulfilled, and it is impossible to breach it. In addition, in order to get a loan, the user needs to deposit a certain amount of the platform’s cryptocurrency. Consequently, if the borrower does not repay the loan, the funds will be charged from his deposit.

Decentralized Exchanges

DEX exchanges operate in a decentralized manner without an intermediary, unlike centralized services. They only act as a platform on which users can trade cryptocurrency. Decentralized exchanges do not own any user data or assets. But there is a disadvantage, because the functionality of such exchanges is limited. For example, there is no possibility of margin trading or the use of market orders, and there is no technical support in case of problems.

The main advantages of decentralized exchanges are quick buying or selling of assets, as well as no need to pass KYC or AML verification.

Farming

This is a way of earning passive income on cryptocurrencies, which most DeFi-platforms provide. The essence of farming is based on supporting the liquidity of the project pool. That is, users contribute their own assets, maintaining the liquidity of the pool. For that, they receive rewards in the form of interest.

Replenish the pool of liquidity can be done in different ways. For example, by mining liquidity and providing currency pairs into the liquidity pool, or lending, by lending your assets for interest.

The main advantages of farming are ease of investment, passivity, and a high rate of return. Experienced investors advise investing assets over a long period of time to get large returns.

Prediction Markets

On DeFi platforms of this type, users predict changes in various areas. It can be the outcome of a soccer game or the results of a presidential election. Prediction markets are a valuable source of data. They allow analyzing the collective knowledge of users to create accurate predictions.

The goal of participants on such platforms is to make money using the information obtained. But it also helps to analyze the cryptocurrency market and manage risk. And the use of blockchain technology guarantees the authenticity and immutability of the data.

Advantages of using DeFi

Let’s look at the main advantages of the sphere that attract users to use DeFi for earning and storing assets.

Accessibility. Not everyone has the ability to open bank accounts or obtain credit, but anyone with an Internet connection can access the DeFi platform. This high level of accessibility means that DeFi transactions happen without any geographic restrictions.

Low fees and high interest rates. DeFi allows two parties to transact directly. Without intermediaries, transaction fees are greatly reduced and parties can negotiate interest rates directly. Lenders who borrow money on DeFi platforms receive higher interest rates than those offered by traditional financial institutions.

Increased transparency and security. Users of DeFi-platforms benefit from the transparency and security that blockchain and smart contracts provide. They preserve the privacy of platform participants and do not reveal the user’s real identity.

Lack of bureaucracy. You don’t have to go through a lot of background checks to get started with DeFi-applications. Financial transactions are performed in a couple of clicks from anywhere in the world where there is internet. Due to this, international payments on DeFi-platforms are usually faster than in banks.

Risks of DeFi-platforms

The main risks in the use of platforms are considered to be the lack of regulation and insufficient protection of users due to decentralization.

– The traditional financial system is characterized by stricter regulation of data protection and transaction security. In the DeFi sphere, there is no regulation, which means that if a user becomes a victim of fraudsters, there is nowhere to turn for help.

– User protection in the traditional financial sphere is higher due to the fact that banks provide customers with guarantees for the safety and repayment of funds.

DeFi has no central regulator, which means the likelihood of becoming a victim of fraudsters is higher. Also, there is the risk of vulnerability, which can be exploited by attackers.

Prospects for Decentralized Finance

Looking at the active development of the crypto sphere and its growth, we can conclude that all related services and technologies have great prospects. The decentralized finance sphere is no exception, even though it is flawed, as most projects are monitoring for vulnerabilities that minimize the risk of the platform being hacked. One thing is certain — over time, DeFi will increasingly compete with the traditional financial system.