Top 5 principles of investing in the stock market

The stock market is where securities such as stocks, bonds, funds and other investment products are traded. The stock market is one of the most popular ways to invest, and many beginning investors want to try their hand at this market.

However, before you start trading in the stock market, you need to understand the basics of investing and follow certain principles. In this article, we will tell you about the top 5 principles of investing in the stock market, which will help you make the right decisions and avoid mistakes.

Study types of stock exchanges and market news

Before you start investing in the stock market, research the different types of stock exchanges and choose the one that’s best for you. Also, follow the market news to keep up with changes and events that can affect stock prices.

There are several types of stock exchanges in the stock markets, each with its own characteristics. The main types of exchanges are:

1. National Exchanges trade national securities. For example, in the USA, this is the New York Stock Exchange (NYSE) and NASDAQ.

2. Regional exchanges work in a particular region and trade securities of local companies.

3. International exchanges trade securities of companies from different countries. For example, the London Stock Exchange and the Tokyo Stock Exchange.

4. Electronic exchanges trade securities via the Internet. Electronic exchanges do not have physical trading halls, and all transactions are made online. Examples of such exchanges are E-Trade and Ameritrade.

5. Currency exchanges where currency trading is carried out.

6. Commodity exchanges on which commodities are traded.

Use stock exchange indexes to analyze the market

Stock market indexes are a great tool to analyze the general state of the market and predict its further development. Use stock exchange indexes to make informed investment decisions.

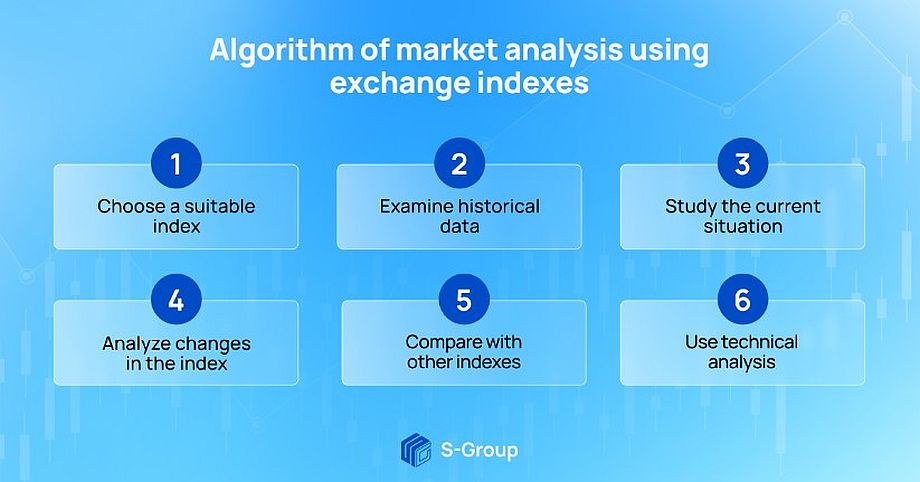

You can analyze the market with the help of stock exchange indexes according to the following algorithm.

1. Choose a suitable index. Depending on which market you are interested in, select the appropriate index. For example, if you want to analyze the U.S. stock market, the S&P 500 index might be a suitable choice.

2. Examine historical data. Get access to the index’s historical data and study its movement over the past few years. This will help you understand how the index reacts to various market events and trends.

3. Study the current situation. Examine the current market situation by analyzing financial news and reports on companies that make up the index. This will help you understand what factors are currently affecting the index.

4. Analyze changes in the index. Examine the changes in the index over the past few days or weeks. This will allow you to determine if there are any trends or patterns in the movement of the index.

5. Compare with other indexes. Compare the movement of your chosen index to other indices that cover the same market. This can help you understand how your chosen index is performing against the general trend in the market.

6. Use technical analysis. Use technical analysis to study the index’s movement charts. This will help you identify possible entry or exit points from the market.

Diversify your investment portfolio

Never invest all of your money in one stock or one type of investment product. Diversify your portfolio to reduce risk and increase potential returns.

You can invest in different stocks and bonds. ETFs or investment funds, real estate, gold and other assets.

Don’t panic when prices fall

In the stock market, stock prices can change quite quickly and not always predictably. Don’t panic if your stock prices start to fall. Remember that investing in the stock market is a long-term strategy, and short-term price fluctuations should not distract you from your primary objective.

Invest only money you can afford to lose

Investing in the stock market involves certain risks, and no one can guarantee you 100% profitability. Therefore, only invest money that you can afford to lose without serious consequences to your life and financial situation.

Conclusion

Investing in the stock market can be challenging and risky, but if you follow the top 5 principles of investing, you can succeed and make money from your investments. Study the market, analyze the data, diversify your portfolio, and invest only money you can afford to lose, and you will achieve your stock market goals.