Stocks VS Bonds

In this new article, we look at two of the most popular assets to invest in — Stocks VS Bonds, their benefits and risks to the investor, and the differences.

The choice of an asset for investment is the first and fundamental step in investing. Before deciding on an investment asset, an investor needs to think about his or her strategy and approach to investing.

In this new article, we look at two of the most popular assets to invest in — stocks and bonds, their benefits and risks to the investor, and the differences.

Definition and Benefits of Stocks

Stocks are securities that companies issue to attract investment as part of an IPO (initial public offering). They represent partial ownership of a company’s capital. The more shares an investor buys, the more of the company he or she owns. When you buy shares, you get a stake in the company and become a shareholder. The rights of shareholders to manage the company depend on the number of shares purchased and the type of assets.

Buying shares gives investors the following opportunities.

- Participation in the management of the company

The investor’s role in managing the company depends on the number and type of shares purchased. If an investor acquires a controlling stake (50%+1), he will have the right to fully manage a company. But the owners of the blocking stake (25%+1) can also take part in the voting of shareholders and challenge the decision of the owner of the controlling stake.

- Earnings on the price difference.

If a company is actively developing, scaling, increasing its income and recognition in the infospace, the price of its shares rises. In such a case, the investor can sell the previously purchased assets and earn income at the expense of the difference in value.

- Receiving dividends

Dividends are part of the profit, which is divided between shareholders. As a rule, dividends are received by holders of preferred shares, as ordinary shares do not guarantee their receipt. Many experienced investors advise keeping dividends and use them as passive income, as their scheme of work is similar to a deposit in the bank.

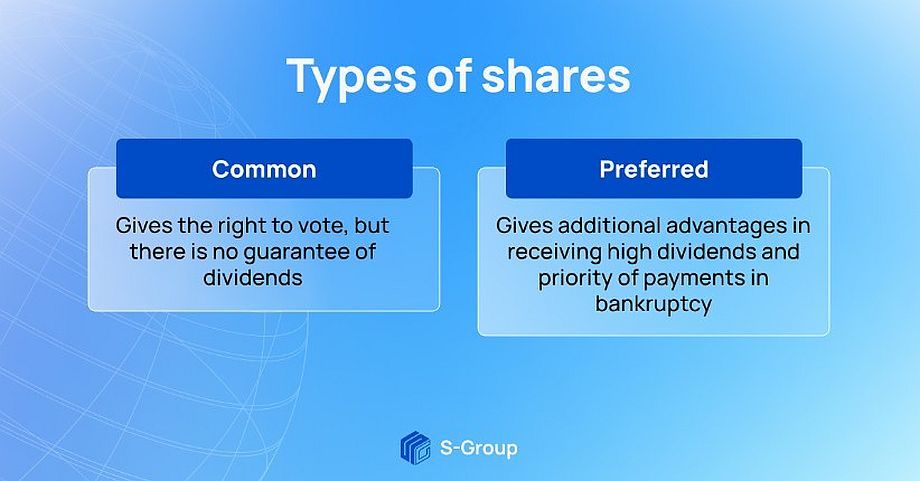

Receiving the above benefits depends on the type of stock the investor purchases. There are two main types of shares: ordinary and preferred. Let’s look at them in more detail.

Stocks VS Bonds

– Ordinary

The most common type of shares on the stock market. The owners of common stock are able to participate in voting of shareholders and company management, as well as in making important corporate decisions.

The main reason to buy common stock is the opportunity to significantly increase capital by increasing the value of assets. But it is important to remember that a company’s stock price can both rise and fall due to a company’s poor reputation or lack of productivity. Therefore, before buying shares, it is important for the investor to carefully study its documentation and further prospects.

The main disadvantage of common stock is a non-guaranteed dividend, because if the company’s profits decline, the management has the right to reduce the amount of payments or cancel them altogether. In addition, in the event of bankruptcy of the company, holders of this type of assets are the last to receive compensation.

– Preferred

Under the scheme of work, preferred shares are similar to the bonds, as they provide the investor with a stable and regular income through the payment of dividends. Holders of this type of stock have larger dividends than holders of common assets. In addition, holders of preferred assets receive priority in compensation in the event of bankruptcy of the company.

An investor’s income depends on the dividend rate. It is determined by several factors: profitability, dividend policy, and the company’s goals. The combination of all these factors determines how much income per share an investor will receive during the reporting period.

The main reasons to buy preference shares are to receive a stable income, low asset volatility and compensation in case of bankruptcy in preference.

The main disadvantages of preferred shares are lower yield and liquidity, as well as the lack of voting rights in the management of the company.

Advantages and disadvantages of shares

Buying a stock is a promising investment option, but it’s important to understand the advantages and disadvantages of this type of asset in order to make the right decision.

Stocks VS Bonds

Let’s start with the pros.

+ High profits. Buying and selling stocks brings more profit than trading options or currencies. This allows the investor to multiply capital and create a source of passive income.

+ Perspectivism. Buying shares, an investor has the opportunity to become a co-owner of the organization, which in the future will become known and popular. Thus, the investor will not only make a profit, but will be directly involved in the development of the company and its recognition.

+ Regular income. Ownership of preferred shares allows the investor to receive a steady income at the expense of dividends as part of the company’s profits.

+ High liquidity. Stocks are an asset that you can both buy quickly and sell at any time due to high demand and liquidity.

Minuses of stocks

– High volatility. The higher the liquidity of the asset, the higher its volatility due to active demand and the ability of large investors to influence the market situation. Stocks are one of the most liquid assets with high volatility because their price changes frequently and depends on news as well as the market situation.

For example, on October 5, 2021, there was a global crash of Facebook, WhatsApp, Instagram, which caused Facebook shares to plummet in price, and Mark Zuckerberg lost $6.6 billion.

– Risk of loss. The success of a stock investment depends a lot on the company’s prospects and performance. If a company performs well, implements new solutions, and brings products to the international market, its profits go up. But in the case of negative performance and lack of motivation in development, profits will fall, which will lead to a decrease in the share price or at all to bankruptcy of the company.

Definition and Benefits of Bonds

Bonds are securities that are similar in scheme of operation to a company’s promissory note to an investor. When an investor buys a bond, he or she is lending the company an amount of money for a certain period of time.

The terms of when the company has to pay back the money and at what interest rate are spelled out in the contract. Therefore, the investor knows exactly when and how much profit he will get if the company does not go bankrupt. If the company goes bankrupt, there is a risk to lose all the money, because bonds are not protected by deposit insurance. That said, bondholders get priority during payouts if the company goes bankrupt.

Buying bonds gives investors the following options.

- Receiving regular payouts. By investing in bonds, an investor can buy and hold assets until the expiration of the contract. At the same time, the investor receives interest from the company, which is paid twice a year.

For example, an investor bought a bond from a company with a 10-year payout period for $20,000 with a 5% annual payout. In return for the investor’s contribution, the company will pay back 5% of $20,000 ($1,000) every six months, and will pay back $20,000 after 10 years. The investor will get a total return of $20,000 + a refund.

- Earnings on price difference. Here it works almost the same way as with buying stocks. The investor buys bonds and if the company shows good results, the price of its assets goes up. Therefore, the investor can sell the bonds he bought when their price goes up and earn on the price difference.

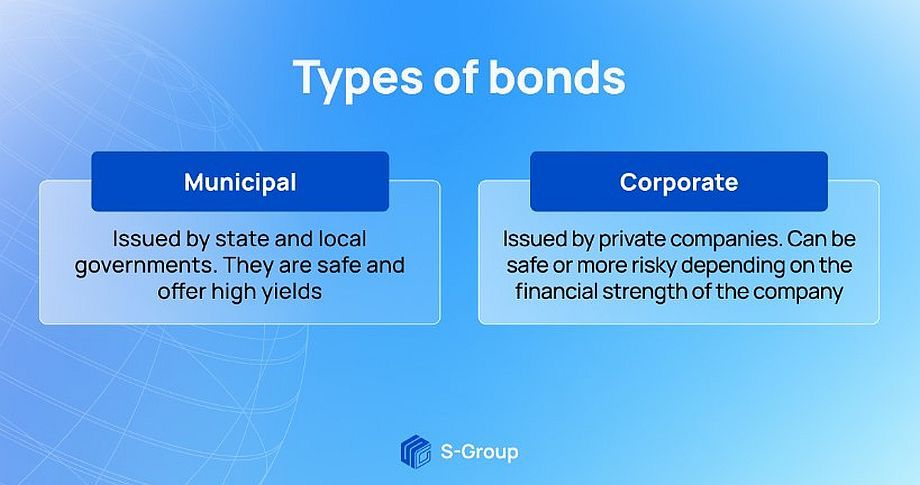

The term of the bonds and the interest rate depends on the type of bonds purchased. There are two main types of bonds: municipal bonds and corporate bonds.

– Municipal

These bonds are issued by state and local governments. They are considered one of the safest types of investment assets and have high yields.

– Corporate

Issued by companies to raise investments for the development of a new project, introduction of innovative technology. Corporate bonds are divided into high-yield and investment bonds. The former offer a high interest rate, but the risk of default is higher. The latter pay less interest, but they are more reliable.

Advantages and disadvantages of bonds

Let’s take a closer look at the pros and cons of bonds for investors.

Let’s start with the pros.

+ Stability. Bonds provide investors with a stable and regular source of income through interest payments. That is, the investor knows exactly when he or she will make a profit and how big it will be.

+ Less risk of loss. Because bonds are an asset with less volatility, the risk of loss is much less than with stocks.

+ Yield. Bonds have higher yields when compared to bank deposits.

Minuses of bonds

– Loss of Value. Bonds can lose value if a company can’t pay interest or repay on time. In addition, assets also lose value if sold before the bonds mature.

– Low yields. Compared to stocks, bonds have lower yields because of their lower liquidity.

Stocks VS Bonds: what to choose to invest in

The choice of asset for investment should directly correspond to the chosen strategy. If your strategy is based on risk loyalty, high returns and the opportunity to participate in the management of the company, you should pay attention to stocks and choose assets of the most promising issuer with good financial performance.

If you’re looking for assets to stabilize income and generate regular returns, bonds are the best option. By investing in bonds, an investor knows exactly when and what kind of profit he or she will get, and the low volatility reduces the risk of losses due to price declines.

When choosing which assets to invest in, experienced investors advise against settling on one type and diversifying portfolios by investing in both Stocks VS Bonds. By understanding the characteristics and advantages of each type, you can create a diversified portfolio in which stocks are responsible for good returns and bonds for income stabilization and regularity.