Forex Market Sentiment: indicators and application

Forex trading implies a constant analysis of the economic situation and trading tools. In addition to fundamental and technical analysis, traders use market sentiment indicators. These indicators help traders to predict changes in prices and open profitable trades.

What is the Forex market sentiment? What market sentiment indicators are there? How to use them in trading? Read about it in this article.

Forex market sentiment: definition and types

Market sentiment is an indicator that reflects the expectations of traders on price changes in the Forex market. It depends on the number and nature of trades that traders make in a certain period of time.

There are two types of market sentiment:

– “Bullish”. If the majority of traders at one moment buy a certain currency, expecting its price to rise, it may indicate a “bullish” market sentiment.

– “Bearish”. If most traders are selling a currency and expecting its price to decline soon, this may indicate a “bearish” market sentiment.

Market sentiment can change depending on news, economic situation, technical indicators and political events.

Market sentiment indicator helps traders to adapt trading strategies to the current situation and to analyze market behavior more deeply.

Market sentiment indicators

Market sentiment indicators are an important tool in Forex trading. They help traders predict price trends and assess risks correctly. They are often used in tandem with technical indicators in day trading, but they are also adapted for long-term trades.

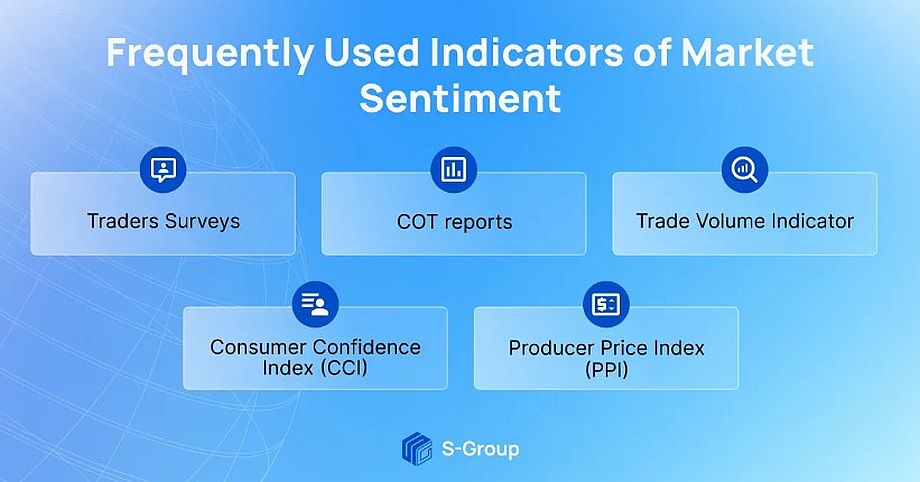

Let’s take a look at the market sentiment indicators that are most often used by traders.

1) Trader Surveys. Analytical companies and brokers make quantitative surveys among traders in order to assess the trend of their predictions on changes in the Forex market. Analysis of such surveys helps to understand the current market sentiment.

2) COT reports (Commitments of Traders). These are reports from the Commodity Futures Trading Commission. They contain data on trading positions of major investors, such as investment banks, hedge funds and corporations. By analyzing the COT reports, the trader can assess the behavior of institutional investors in the Forex market and predict future changes.

3) Volume indicator. It shows the trading volume of a certain asset for a selected period of time. In Forex trading volume increases when prices are rising, indicating a bullish sentiment, and decreases when prices are falling, indicating a bearish sentiment.

4) Consumer Confidence Index (CCI). It is an economic indicator that shows the general sentiment of consumers in terms of the current economic situation, their expectations for the future and their assessment of stability. This index helps a trader globally assess financial markets and build a proper trading plan.

5) Producer Price Index (PPI). It represents the price changes of the primary seller’s (producer’s) products, and it is an indicator of inflation in the economy. The rise and fall of producer prices affects the financial markets, which allows the trader to predict changes in it.

It is important to remember that in the Forex market there is no universal indicator that is suitable for all trading instruments and market situations. A trader needs to analyze different indicators and adapt them to his own trading.

Application of market sentiments indicators

The most successful application of market sentiments indicators is their combination with principles of technical and fundamental analysis.

Let’s consider the most popular applications of the market sentiments indicators.

– Seeing the whole market situation. Traders study several indexes at the same time to see the whole picture of what is happening in the market. Trading will be profitable if analysis of market sentiment indicators is included into the trader’s trading strategy.

– Trading currency pairs. If traders’ sentiments are optimistic, it signals about growth of price, if they are pessimistic – about decline. Paired with technical indicators, a trader can calculate the best entry and exit points.

– Back trend signals. Market sentiment indicators can also signal a reverse trend. For example, if mood indicators are opposite to the current price growth, it is possible to predict its decline in the nearest future.

– Risk management. Using market sentiment indicators a trader can calculate the spikes in volatility in day trading and prevent losses.

Conclusions

Market sentiment indicators are useful for general estimation of the market situation, but a trader should not rely only on them during Forex trading. They can change under the influence of various factors, so it is advisable to combine different indicators and strategies so that they bring the maximum benefit to the trader.

It is important to have enough experience to correctly interpret market sentiment indicators and implement them into trading. This will allow the trader to competently manage risks and make profitable trades.