Cryptocurrency trends in 2023

2022 was not the most successful year for the cryptocurrency market. There were numerous fluctuations and a significant decline in profitability. According to statistics, the total capitalization of cryptocurrencies decreased by 12%, which caused alarm among investors. However, analysts and experts from Messari and Glassnode predict that 2023 will be a watershed year for the cryptocurrency market.

We studied analytics and expert’s opinions and prepared an article with an overview of the main crypto trends for 2023.

Cryptocurrencies on the PoS consensus algorithm

Proof of Stake (PoS) is becoming an increasingly popular consensus algorithm. PoS cryptocurrencies such as Cardano, Polkadot and Ethereum 2.0 are expected to grow in interest in 2023. Due to their relatively low power consumption and improved security, PoS tokens could become major players in the cryptocurrency market.

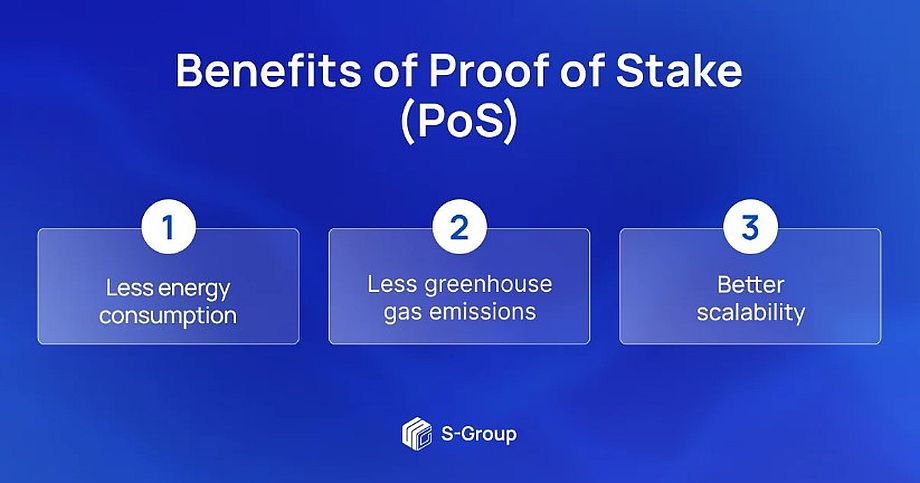

The main benefit of PoS is its energy efficiency.

– Less energy consumption. Unlike PoW, where miners spend a lot of energy solving complex mathematical problems to validate transactions and create new blocks, PoS systems are based on holding cryptocurrency. This significantly reduces energy consumption, since there is no need to use powerful computing resources for mining.

– Less greenhouse gas emissions. PoS networks produce fewer greenhouse gas emissions due to their lower power consumption. This makes them more environmentally friendly than PoW networks, which use significant amounts of electricity and can contribute to increased greenhouse gas emissions.

– Better scalability. PoS networks also improve the scalability of blockchain technology because they can process more transactions with less energy.

However, it is worth noting that not all PoS algorithms are created equal. Their greenness varies depending on the specific implementation and system parameters. In general, PoS algorithms are a greener and more scalable alternative to PoW.

Cross-Chain technology

As the cryptocurrency market develops, the need for interactions between blockchains increases.

Cross-Chain technology plays an important role in the development of the blockchain ecosystem, allowing different blockchain platforms to interact with each other, increasing liquidity, enabling the exchange of data and digital assets from different blockchains, and facilitating collaboration between projects.

Cross-Chain technology works by creating bridges between blockchains that enable the transfer of information and assets between networks.

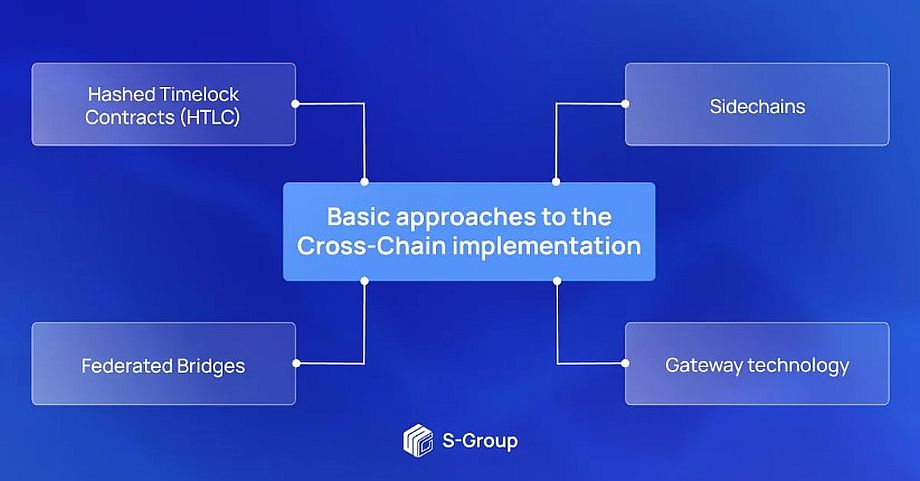

Basic approaches to the Cross-Chain implementation.

– Hashed Timelock Contracts (HTLC). HTLC contracts use cryptographic hashes and timelocks to secure transactions between different blockchains. They are used in conjunction with atomic swaps and allow users to exchange assets without having to trust each other or involve an intermediary.

– Federated Bridges. These are cross-blockchain solutions in which a group of nodes (federation) controls the transfer of assets and information between blockchains. Federation members act as intermediaries, creating multi-signature wallets and signing transactions to ensure exchange security. An example of such a bridge is Blockstream’s Liquid Network for exchanges between bitcoin and other cryptocurrencies.

– Sidechains. Sidechains are auxiliary blockchains that operate in parallel with the main blockchain and allow the transfer of assets between them. Assets can be frozen on the main blockchain and released on a sidechain, where they are used within another blockchain. Assets can then be moved back to the main blockchain when transactions on the sidechain are completed. An example of the use of sidechains is the Plasma project for Ethereum.

– Gateway technology. Gateways are contracts on two blockchains that capture pledges of assets and issue corresponding tokens on the other blockchain. In this way, assets can be exchanged between blockchains. An example of such a solution is Cosmos, which uses gateways to enable interaction between different blockchains.

Different approaches to Cross-Chain implementation can be combined to achieve a higher degree of security and efficiency. With the development of Cross-Chain technology, the cryptocurrency market is becoming more flexible, integrated, and resilient to potential threats.

Decentralized Finance (DeFi)

DeFi continues to gain momentum and will become an even more in-demand trend in 2023. Decentralized exchanges (DEX), staking and decentralized credit platforms are predicted to increase their market share. Integration with traditional financial institutions and improved user experience will be an important growth factor for DeFi.

DeFi (decentralized finance) is an ecosystem of financial applications and services based on blockchain technology that aims to democratize and decentralize the traditional financial infrastructure. With DeFi, users can access a wide range of financial instruments, such as loans, deposits, insurance, asset trading and derivatives, without using traditional financial intermediaries, such as banks and stock exchanges.

Main advantages of DeFi.

1. Availability. DeFi-applications provide access to financial services for people all over the world, even those without access to traditional banking services.

2. Transparency. Thanks to open source, decentralized financial platforms provide transparency and auditability for all participants.

3. Security. DeFi-applications are based on smart contracts that automatically perform transactions and operations according to set conditions, reducing the possibility of fraud and errors.

4. Flexibility. The DeFi ecosystem consists of many compatible protocols and platforms that can be easily integrated with each other to create new products and services.

5. Simplicity. DeFi platforms generally do not require prior approval or identity verification, allowing users to access services quickly and anonymously.

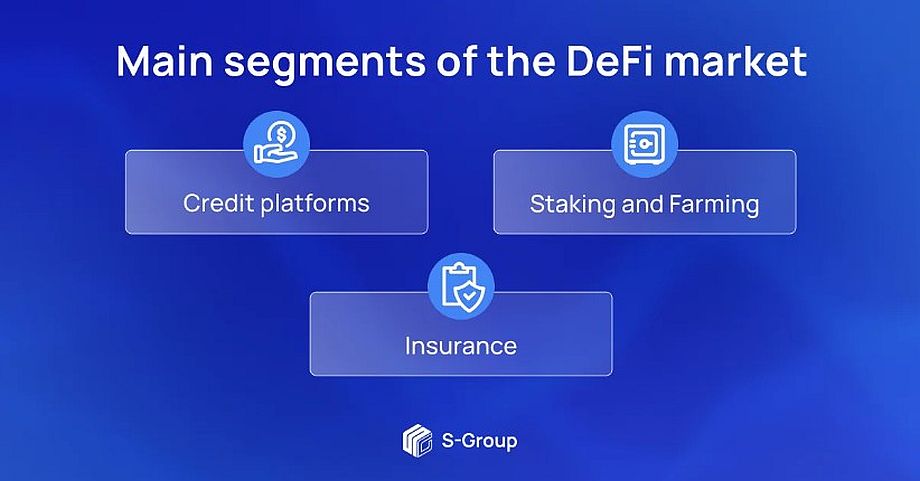

Main segments of the DeFi market.

– Credit platforms. They allow you to borrow and lend cryptocurrencies without intermediaries. Examples of popular platforms: Aave, Compound and MakerDAO.

– Staking and Farming. Staking and farming allow users to earn interest or rewards for participating in decentralized protocols.

– Insurance. DeFi-insurance protects users from losses related to smart contract failures, hacker attacks or other risks. Examples of insurance platforms in the DeFi sector: Nexus Mutual and Cover Protocol.

Going forward, the development of DeFi could lead to new financial products and instruments, as well as facilitate integration with traditional financial institutions and sectors of the economy. This could facilitate the wider diffusion of cryptocurrencies and accelerate the adoption of blockchain technology at the global level.

The rise in popularity of the NFT

NFTs (Non-fungible tokens) continue their rapid development, especially in the context of meta universes. In 2023, digital arts, virtual land plots and avatars are expected to grow in popularity. Examples of successful NFT projects are Bored Ape Yacht Club, CryptoPunks and Decentraland.

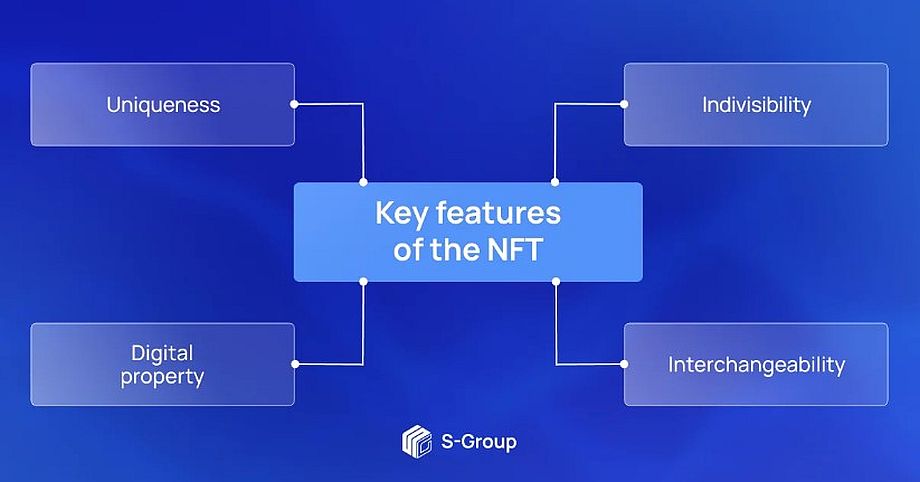

Key features of the NFT.

– Uniqueness. Each NFT has unique characteristics not found in any other token. This allows users to collect rare and valuable items, creating a market for collecting and investing.

– Digital property. NFTs enable users to prove ownership over digital assets such as art, music or videos. Thanks to blockchain technology, the owner of an NFT can trace the history of transactions and verify the authenticity of the asset.

– Indivisibility. Unlike other cryptocurrencies, such as bitcoin, which can be divided into smaller units, NFTs are indivisible. This means that they cannot be divided into parts or used as currency.

– Interchangeability. NFTs are not interchangeable.This means that each token has unique characteristics and cannot be replaced by another token.

Overall, NFTs offer opportunities for individual and corporate investors, content creators, designers, musicians and many others. Their diversity and uniqueness make NFT one of the most interesting and discussed trends in the world of cryptocurrency and blockchain technology in 2023. We also want to emphasize that the future of meta universes and NFT is closely connected to the development of Web 3.0.

Web 3.0

Web 3.0 is a new stage in the development of the Internet, which implies decentralization, security and transparency. In 2023, technologies related to Web 3.0, such as decentralized applications (DApps), decentralized identifiers (DIDs) and meta-villages, are expected to be actively developed. This will enable users to share data and digital assets without intermediaries, providing privacy and control over data.

Key features of Web 3.0.

– Decentralization. Web 3.0 seeks to reduce reliance on centralized servers and controlling authorities such as corporations and governments. Web 3.0 uses blockchain technology, P2P networks and distributed storage systems to create a decentralized infrastructure.

– Privacy and security. Web 3.0 improves the privacy and security of user data by using cryptographic techniques and other security mechanisms, such as self-signed identifiers (SSI) and decentralized identification systems.

– Compatibility. Web 3.0 emphasizes compatibility and interoperability across platforms, blockchains and applications. This allows users and developers to easily transfer data and assets between different systems.

– Tokenization. Web 3.0 integrates the concept of asset tokenization, enabling the creation and exchange of digital assets on blockchain platforms.

– Decentralized applications (dApps). Web 3.0 supports the development and use of decentralized applications (dApps) that run on blockchain technology and decentralized networks.

Despite all the potential benefits of Web 3.0, the technology is still under development and not fully implemented. It is expected that in the coming years we will see many new projects and applications based on this technology.

Bitcoin in 2023

Bitcoin remains a major player in the cryptocurrency market and continues to show stability.

One of the main factors affecting bitcoin in 2023 could be the growth of institutional investments in cryptocurrencies. Many large financial companies, including JPMorgan, Goldman Sachs and Morgan Stanley, have already begun to provide clients with access to bitcoin and other cryptocurrencies, which could lead to increased demand and stimulate price growth.

There may also be changes in regulation of cryptocurrencies that could affect their value. If governments and regulators provide a more favorable environment for cryptocurrencies, this could lead to increased investor confidence and demand for cryptocurrencies.

On the other hand, technical innovations and changes in the bitcoin network can also affect its price. For example, the development of more efficient consensus algorithms or improvements in network bandwidth could lead to improved transaction speed and efficiency and increased interest in the cryptocurrency.

In addition, changes in supply and demand in the market could also affect the bitcoin price in 2023. If demand for cryptocurrencies grows faster than supply, it could lead to an increase in price.

Cryptocurrency regulation

As the number of cryptocurrency investors and companies increases, governments around the world will strengthen their regulatory measures. Cryptocurrency legislation to combat money laundering, tax evasion and fraud is expected to be active in 2023.

One of the main issues related to the regulation of cryptocurrencies is the definition of their legal status. Some countries have defined cryptocurrencies as digital assets or commodities, others as currency or means of payment. This affects taxation, registration and licensing requirements, and accessibility to a wide audience.

One of the most significant regulators in the cryptocurrency industry are financial regulators, such as the SEC in the US and the FCA in the UK. They have the right to inspect and monitor cryptocurrency companies and can impose fines or prosecute violations of the law.

Some governments impose special programs to regulate cryptocurrencies, such as licensing exchanges and wallets, as well as KYC and AML verification compliance requirements.

It is worth noting that cryptocurrencies are a new and rapidly evolving market, where rules and regulations change and are updated in line with changing technology and the economy. It is important that regulation of cryptocurrencies is balanced and fair to protect investors and foster innovation.

Conclusion

Cryptocurrency trends in 2023 present many opportunities for investors and developers. Given the volatility of 2022, this year promises to be more positive and productive for the crypto industry. From PoS algorithms and Cross-Chain technology to the regulation and Web 3.0, cryptocurrencies continue to transform the world of finance and digital assets.