Bull and Bear cryptocurrency markets

Bull and bear markets are fundamental concepts in the field of crypto trading. Their understanding allows a trader to correctly react to price spikes, adjust the trading strategy and adapt it to the current situation.

What are bear and bull markets? What is the difference between them? What trading strategies are suitable for each of them? Read this article to learn the answers to these questions.

Bull and bear markets: definition

Bull and bear markets are based on the concept of a trend. A trend is a move in the asset’s price in one direction over a certain time frame. It is an uptrend when the asset price is in a rising period and a downtrend when the asset price is falling.

A bull market is a period of prolonged uptrend when cryptocurrency prices are steadily rising. It is characterized by optimistic sentiment, high investor confidence and strong economic indicators. A bull market is defined by an increase in the price of an asset by more than 20-30% from the previous price minimum.

A bear market is a period of prolonged downtrend when cryptocurrency prices are steadily falling. It is characterized by pessimistic sentiment, low investor confidence and weak economic indicators. A cryptocurrency market can be considered bearish when asset prices drop more than 20% from their previous maximum and continue to fall.

A trader should remember that bear and bull markets are constantly changing and no one can predict the exact time of a trend reversal for sure. That’s why it is necessary to make balanced decisions and be able to adapt your trading strategy to the current market situation.

Bull market vs bear market in crypto sector

Cryptocurrency differs from classic investment assets in its high volatility and development dynamics, which makes cryptocurrency markets tend to move faster than others. Therefore, the duration of bull and bear crypto markets is usually shorter than, for example, stock markets — from a few days to a few months.

One of the key differences between markets is the asset demand. In a bull market, it is higher than supply; in a bear market, it is the opposite. This is due to the fact that traders do not want to sell cryptocurrencies during a rise in price, and during a prolonged decline — to buy.

The bull market movement

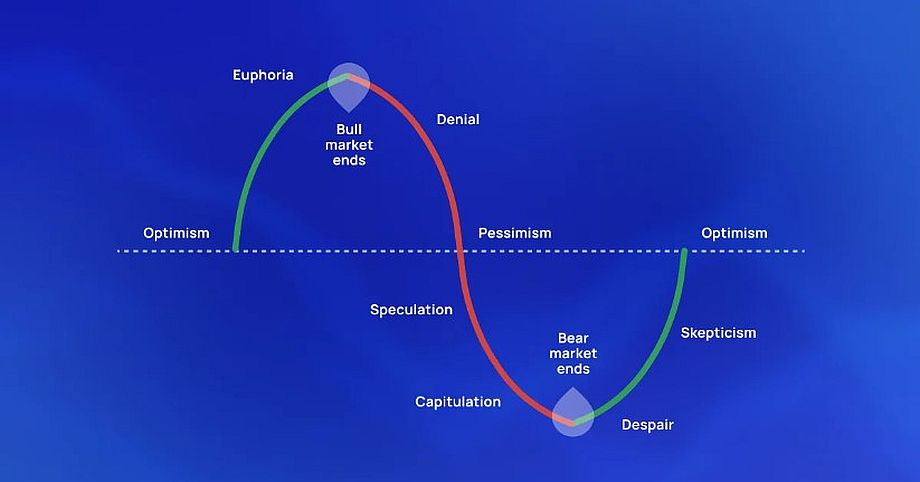

The bull market has four main phases.

1) Despair. The period of the downtrend reversal, when the minimum of the asset price has already passed, but the sentiment of traders remains pessimistic.

2) Skepticism. In this phase the market can be in a sideways movement: the price is either rising or falling. Investor confidence is still low.

3) Optimism. Indicators are improving and investor confidence is strengthening. Asset prices begin to rise steadily.

4) Euphoria. Price growth speeds up, and traders significantly increase profits. As soon as this phase ends, the market reverses into a downtrend.

Traders who identify the uptrend in time will be able to buy the desired cryptocurrencies in advance and make potentially high profits in a bull market. Subsequently, a trader needs to sell assets in time before the trend reverses in order to lock in profits and wait for the next reversal.

To increase the potential profit, traders can use the leverage of an exchange or broker. With leverage, a trader can buy more cryptocurrency and significantly increase income during a price rise. But it is worth remembering that trading with leverage implies both high profits and higher risks.

The bear market movement

Consider the four main phases of a bear market.

1) Denial. The price of the asset has reached a maximum, but the mood of traders remains optimistic.

2) Pessimism. In this phase, prices decline rapidly as many traders have identified a trend reversal and started selling cryptocurrency in mass to lock in profits.

3) Speculation. Traders invest a lot of money in the market, but the trades are short-term. The price charts may be in a sideways movement temporarily, but the downtrend still dominates.

4) Capitulation. Asset prices gradually decrease, traders react by buying only to positive market news. After this phase, the market reverses into an uptrend.

In a bear market, traders can also make profits. One option is to buy a cryptocurrency during a price decline and wait for the next bull market to sell it. In this case, the trader should properly assess the risks and be prepared for the fact that the downtrend can continue indefinitely and it will take a long time to wait for the prices to rise.

A trader can also open short positions, which allow earning on a cryptocurrency price decrease, or wait for a correction, when the price of the asset can increase by 10-15% in the short term. You can read more about the instruments that bring profit in the bear market in the article.

Conclusion

The movement of bull and bear markets is directly dependent on the sentiment of traders and their trading activity. Despite this, it is impossible to determine the reversal point of the market trend in advance. Traders should remember that the crypto market is cyclical and the price can go in the opposite direction at any moment. Therefore, you need to be able to adapt quickly and make informed decisions based on market and economic analysis, not on emotions.

When trading cryptocurrency, it is important to remember its volatility and high risks. Experienced traders recommend diversifying your portfolio and adding different types of crypto assets, which may behave differently during bull and bear markets. In this way, losses can be avoided or reduced if the trend turns contrary to investor’s expectations.