Who are the brokers

According to a Gallup poll (Institute of International Social Survey) in 2021, 56% of Americans invest in stocks in the stock market, one in ten in cryptocurrencies, and there are about 10 million Forex traders worldwide.

If you decide to trade on the exchange: stock market, currency, cryptocurrency, there are two ways — to do it yourself or with the help of a broker. The latter is an intermediary between the seller and the buyer in the securities, precious metals, cryptocurrency or Forex markets.

In this article, we will examine who stockbrokers are, what they do and how to choose a brokerage company.

Stockbrokers and Crypto-brokers

Stockbrokers are professional market participants who have access to an exchange and a license. If you want to buy stock on the stock exchange, you can’t go anywhere without a broker. The thing is that individuals have no right to place orders on the stock exchange. Only brokerage companies that have a license can do that.

Brokers solve client’s problems, guarantee the fulfillment of financial obligations, reduce risks, save client’s time and provide stability in partnership relations. For their work, they receive remuneration in the form of a commission or a fixed amount of money.

Brokerage companies are regulated by the state. In order to provide brokerage services, the company must be licensed. In addition, the selected company must be an accredited member of the stock market.

Steps of interaction with the stockbroker

After the broker has been chosen, you need to conclude a contract with him and open an account from which the purchase and commission are deducted. On your behalf, the brokerage company performs operations, calculates and withholds income tax.

Important. Before accepting a transaction order, the broker must warn you of any costs that may be incurred. If the broker does not warn you about all sorts of costs or does not tell you about the nuances of the transaction, due to which you have lost money, you have the right to demand compensation from him. If it does not work out “amicably”, you can go to court.

But, in exchange trading, there are often situations where a decision must be made quickly. In this case, you agree with the broker not to give information about the additional costs. Keep in mind that it is a risk, because it is not possible to demand compensation for losses in case of unsuccessful trading.

Then choose a convenient way to communicate with the broker: online (using the trading terminal/mobile app) or by phone. After that you give your orders, receive the money and withdraw it from the brokerage account.

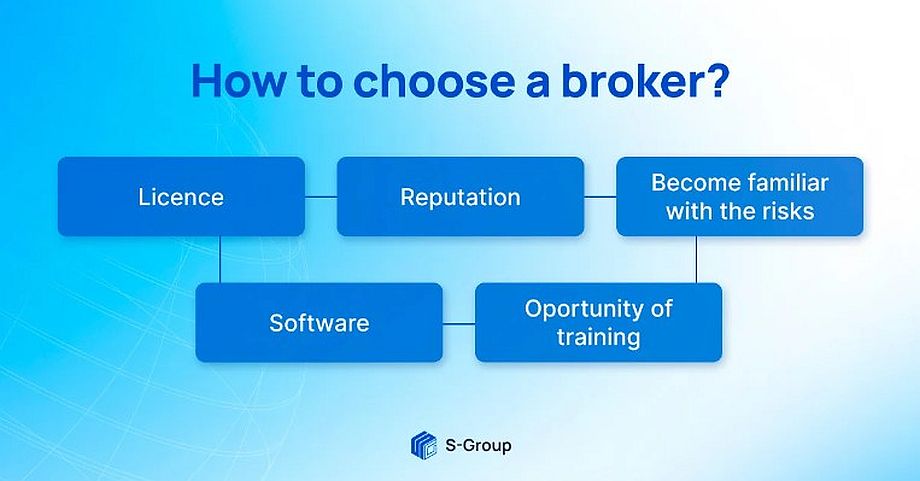

How to choose a broker

Choosing the wrong broker = lost money. That is why you have to choose a brokerage company very carefully. What to study and check when choosing a broker?

1. License. Check in special sources, for example on the international website aggregator — info-clipper.com/en/, whether the broker has a license. If they are not, they are illegals, and it is dangerous to cooperate with them.

2. Reputation. Study the information about the company that interests you, read the customer reviews, see if there have been any loud, scandalous stories involving it.

3. Become familiar with the risks. Before signing a contract, carefully read the document with the risks, which describes what can cause you to lose money.

4. Software. If you want to trade over the internet, find out what you need to install to do so and how the trades go: through the website or the trading terminal. Find out if you can install a trading terminal on your computer.

5. Opportunity of training. A broker is an intermediary. Therefore, you will have to develop your own investment strategy. Some companies offer free/paid training: webinars, courses, training videos, consultations, etc. In addition, sometimes brokers have a demo mode, where you can practice trading and not spend money.

Crypto brokers

A cryptocurrency broker is an intermediary between a seller and a buyer in the cryptocurrency market. As a rule, crypto-brokers are represented on OTC (over-the-counter) platforms. This is an over-the-counter market, where they trade according to informal rules. Cryptocurrency brokers appeared after the rise in the price of bitcoin in 2016-2017. In July 2021, news broke that JP Morgan was the first major bank to offer clients broad access to retail cryptocurrency funds.

What distinguishes cryptocurrency brokers from stockbrokers

– Large leverage of up to 1:1,000, meaning $1,000 of a client can turn into $10,000.

– Diversity in tools, as crypto brokers provide analytical tools and charts.

– They work with different assets: cryptocurrency, fiat money, contracts for difference (CFD), commodities, indices, precious metals, securities, Forex.

Among the possible problems of working with cryptocurrency brokers are:

– the cryptocurrency market is poorly regulated, so state organizations cannot ensure the protection of funds;

– low anonymity, because the KYC (Know your customer) procedure is stricter than on the exchange.

Broker: intermediary or assistant

When concluding a contract with a broker, remember that he is only your “hands” in the securities and currency market. Therefore, it is very important to understand yourself how the exchange works, monitor the market, analyze information and make decisions. Be sure to check the license of the brokerage company, its reputation and reviews, so as not to run into unscrupulous organizations.

On the S-Group blog, we talk in detail about the intricacies of the foreign exchange and stock markets, about their players and closely monitor all the changes in these markets. Subscribe to our newsletter to be the first to receive notifications of new articles.