What is the Forex Market

What is the Forex Market? In this article, we will analyze the basic concepts in the Forex market that you need to know in order to work on it.

So, Forex is an abbreviation for foreign exchange, which literally translates as international exchange. The market itself is a large telecommunications network that brings together the largest banks in the world.

Each member bank has its own exchange offices. We buy or sell currency at these points, and the bank carries out similar actions in the Forex market. Therefore, one way or another, we are also members of the Forex Market. But, its main participants are central, commercial banks, large investment companies, transnational corporations.

Dozens of popular currencies are available on the Forex market: US dollar, euro, British pound, Japanese yen, Swiss franc, and many others.

The peculiarity of the market is that the currency is not sold in its pure form, but in currency pairs. For example, the EUR / USD pair. Making an operation, we buy or sell euros for dollars. The currency that comes first in the pair is called the base currency. That is, the currency with which the operation is performed. In second place is the quoted currency. That is, the currency in which the calculations are made.

The price varies on whether the currency is being sold or bought. In the foreign exchange market, the buy price is called ASK, the sell price is BID. The difference between the buy and sell price is called SPREAD. That is, the commission that the exchange office takes for the operation.

When making a transaction for a small amount, not much is spent on commission. But, imagine a huge corporation with millions of budgets, which needs to make a currency exchange. She will not contact an ordinary exchange office for two reasons:

- The exchange office does not have the required amount of funds

- Each bill will be on the account

Large companies operate in the Forex market. Firstly, the liquidity of currencies there is much higher than in exchange offices. Secondly, the commission is much lower. SPREAD in the foreign exchange market is measured in points. Quotes on the Forex Market are calculated up to the fifth digit after the decimal point (0.00001). For example, the EUR / USD currency pair was worth 1.05000, and then the price changed to 1.05001. When such a price change occurs, in the foreign exchange market it means that the price has changed by one point.

Operations are carried out in certain volumes – lots.

To make a transaction on the Forex Market, you must have at least 100,000 base currency. In our example, 100,000 euros. One pip change in price will result in a gain or loss of $ 1.

What if there is no amount of 100,000? Working through brokers it is possible to get leverage. Standard leverage 1: 100. This means that you do not need to keep the entire amount at your own disposal to complete a transaction in the amount of 100,000. It is enough to own an amount that is 100 times less, that is, 1000 euros. The missing amount is added by the broker.

Today it is possible to split lots. Many brokerage companies provide the ability to trade 0.1 or 0.01 lots. Thus, the threshold for entering the Forex market is considered low. The amount of 1000 units of the base currency is taken as collateral by the bank or broker for the period of the open transaction.

The main advantage of the Forex Market is 24/5 work. This is done due to the fact that all trading on the market is divided into 4 sessions:

- asian

- european

- american

- pacific

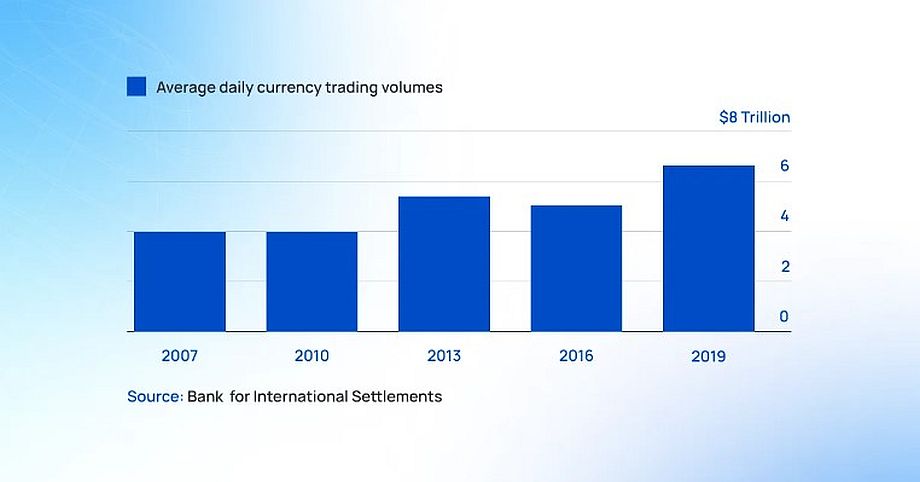

Another advantage of the market is the large volume of currency. Forex turnover per day reaches 7 trillion dollars, which is 10 times higher than the turnover of the world stock market.

It is possible to make money on the Forex market not only on the growth of the currency, but also on its fall. It is interesting that investors who make money on the growth of the currency are called bulls, and those who make money on the fall are called bears.

Forex Market, or the foreign exchange market, is one of the most highly profitable, therefore the largest banks in the world take part. In the following articles, we will tell you what transactions can be made in the foreign exchange market, what an order is, and how to fix profit and loss. Do not miss.