IPO: everything investors need to know

We have already talked about the IPO and the procedure for the initial public offering for the investor. In this article, we will study the topic in detail and discuss how investors and companies can benefit from participating in the IPO.

IPO: everything investors need to know – History

The first unofficial mention of the IPO was in the times of the Roman Republic (509-27 B.C.). The property of the publics (private entrepreneurs who took land, pastures, or income from the state) was divided into shares. The latter were sold to investors in the over-the-counter market of the Roman Forum. The assets fluctuated in price, on which speculators made money.

In 1288 a Swedish company, which was engaged in copper mining, publicly floated securities. This event is considered to be the first official mention of an IPO.

The modern history of IPOs began in the 1970s, after the liberalization of the global financial market. The most striking year was 1999. IT companies began to develop rapidly and about 2,000 organizations entered the global IPO market.

Why are companies involved in IPOs?

IPO (Initial Public Offering) is an initial public offering. By participating in an IPO, the company ceases to be private and becomes public. This means that anyone can become a shareholder.

The JSC (public company) has its own rules:

- There is no single owner, because the holder of even one share partially owns the organization.

- the shareholders are divided into majority and minority shareholders.

The majority owns a controlling stake (50% +1) or a blocking stake (25% +1). The controlling interest enables the investor to independently manage the company and make important decisions. At the same time, the owners of the block shareholding can veto a decision with which they do not agree, and put it up for discussion.

Minority shareholders own a small block of shares and cannot manage the organization. They receive dividends or speculate on price differences.

The main reason for a startup to go to an IPO is to attract investment for the development of the project.

Also, participation in IPOs allows companies to:

– Retain and attract the best talent for the job by offering them stock options in the company. This is an agreement that allows the employee to buy shares in the company at a predetermined price;

– To be listed on the world’s major stock exchanges;

– Use the assets in a merger or takeover of organizations, covering part of the payment. For example, when Facebook bought WhatsApp, the founders of the messenger received $19 billion in assets;

– Increase credibility in the marketplace and make the brand recognizable, so lucrative deals can be struck;

– Get money on a non-recourse basis, which distinguishes IPOs from loans from banks;

– To expand the business, improve equipment, increase wages for employees.

The disadvantages of participating in an IPO for companies:

– there is a risk of going bankrupt if the asset price falls;

– everyone will know about the failed IPO, which will have a negative impact on the company’s reputation.

To participate in the IPO, companies need the finances to issue securities (at least $1 million dollars), as well as a lot of time and resources to create a promotional presentation for investors. A lot of attention should be paid to financial documentation, because before entering the IPO, it is thoroughly checked by the regulatory authorities.

IPO: everything investors need to know | The benefits and risks for the investor

IPO: everything investors need to know. It is a way of passive income for the investor and a great opportunity to contribute to the development of the start-up and receive a profit from the growth of the company’s shares.

Important. To avoid speculation, there is a lock-up period of 92 days during which shares cannot be sold. During this time, securities may rise or fall in value.

If you see assets falling in value, you can make a forward contract. That is, fix the price of the asset for some or all of the security and sell it after the period ends.

But don’t get too excited. For example, Facebook shares during the lock-up fell by 50% and many investors began to sell them, which they now regret. The reason for such a fall in the stock was the doubts of investors about the company’s clear development strategy and business model. But amid the rapid growth of Facebook’s financial performance, the stock began to rise in price, as investors saw that the company is reliable and profitable.

Therefore, before investing in the company, one should carefully study the information about the company, the management, learn the development strategy and the business model.

In addition to gaining profit, participation in the IPO gives the investor the opportunity to participate in the management of the organization and expand the investment portfolio.

IPO: everything investors need to know

But there are risks:

– there is no guarantee that the company’s stock will rise after the IPO, so the investment may not pay off;

– to invest in assets, you must have an account of at least $ 1000, and preferably $ 5000-10000;

– the IPO may not take place — the organization may be withdrawn due to violations;

– the value of the assets will collapse due to the bankruptcy of the company, the negative events which take place in the company, and the investor will lose everything.

How to minimize risks for the investor: 4 tips

1. Don’t invest all of your capital in one company. Brokers offer at least 15-20 IPOs throughout the year. By investing in several organizations, you can earn on some stocks and at the same time invest in others. That way, there will always be profit.

2. Study information about the company you want to invest in. Pay attention to the business model, how much revenue has grown, whether the company has debts, study the list of investors.

3. Don’t rush to sell assets after the price drops. Consider the example of Facebook. Whether the stock will rise or fall depends on the organization’s performance. Plus, you lose money on commissions if you sell assets early.

4. Pay attention to the underwriter bank (the bank that helps the company go public). If the underwriter has a good reputation, it will not participate in the IPO of a questionable company.

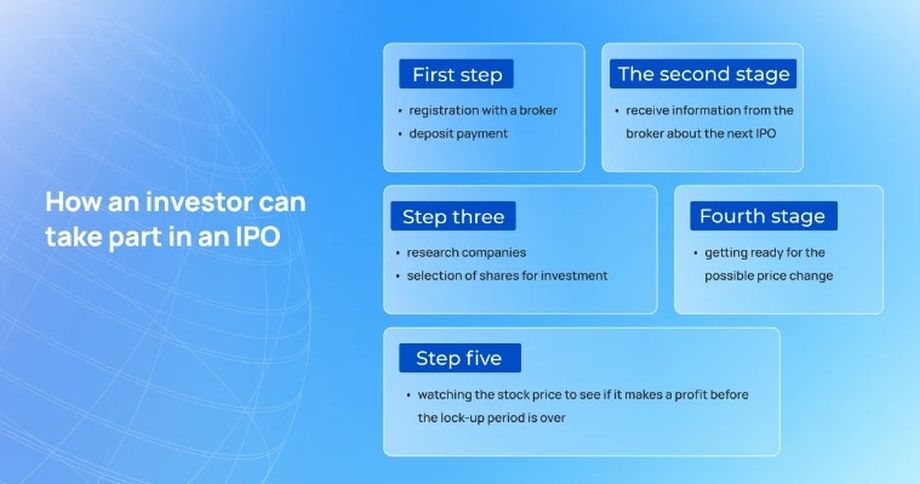

How to take part in the IPO

So, what should an investor do if he/she wants to participate in the IPO? IPO: everything investors need to know

The first is to register with a broker and make a deposit. The amount depends on the broker with which you will work. For example, American brokers require a deposit from $5000, but you can work with them directly. If you work through intermediaries, the deposit will be less, but you will have to pay a commission.

The second thing is to get information about the nearest IPO, in which you can participate.

The third thing is to study information about the companies and choose the stocks you want to invest in.

Fourthly — be prepared for price changes. There are situations when the demand for shares is greater than the supply. This was the case with Twitter stock. The initial price was $17-20, then it went up to $23-25 and then to $26. When that happens, there can be a decrease in allocation (the level of allowed purchase, which determines how many shares participants can buy). For example, if you wanted to invest $20000, but demand exceeded supply 5 times, you can invest only $4000.

Fifth — up to the end of the lock-up period to watch the growth of assets in order to understand whether it will be possible to earn on them.

Stages of company’s IPO

- Preparation of the company

You need to evaluate the business and audit the assets, to determine the future capitalization.

- Preparing for IPO

The company chooses the underwriter bank which will arrange the IPO. The underwriters invest in the IPO and buy the company’s shares before the flotation. They make money on the difference in the pre-IPO share price and the price at the start of trading.

When the bank is selected, negotiations are held. During these negotiations, the price of assets, their type, the amount of funds to be attracted are determined. After that, a document with financial statements, targets for raising funds, list of shareholders, management data is sent to the regulatory body of a particular country, for example, in the USA — it is the Securities and Exchange Commission. If the commission accepts the document and approves it, the date of the IPO is set.

- Road-show and flotation

The company starts to attract investors and runs a road-show (advertising campaign). The investors are told about the organization, its advantages, presentations, and other PR-activities. After that, applications from potential investors are collected. If necessary, the share price is adjusted. The assets then appear on the exchange, where they can be bought by anyone.

Summary articles

IPO: everything investors need to know

– For the investor, an IPO is a great opportunity not only to make a profit, but also to expand the investment portfolio and help develop a promising start-up.

– To minimize investment risks, carefully study information about the company, pay attention to its underwriting bank and invest in several organizations.

– IPOs are a chance for companies to get investment and become known in the market.

– To get more investment, companies should spend a lot of time choosing an underwriter and creating a presentation to potential investors.

You can learn even more about investing in IPOs here.