What is mining: definition, methods and types

Mining is one of the ways to get cryptocurrency. In this article, let’s break down what it is, how it works, what ways and types there are.

Definition and principle of mining

In the world of cryptocurrencies, it means the process of mining new coins by solving complex computational problems.

The principle of mining is as follows. Cryptocurrency transactions are combined into blocks. To validate the transaction, many miners simultaneously try to match hashes to the blocks. A hash is a code in which transaction data is encrypted. Whoever solves the problem first is rewarded with cryptocurrency.

The main difficulty is the PoW (Proof of Work) algorithm, which means proof of work. In other words, miners with powerful computing equipment have more chances to decrypt the hash and get the reward for the block. The power of the equipment directly affects the number of hashes a miner can calculate per second and the profit he will get. That is, the more powerful the equipment, the more coins the miner receives.

Tasks that mining solves

1. Functioning of transactions. Transactions within the blockchain are made only after miners verify and approve them. Once a transaction is approved, the buyer of the asset receives it in his account, and the seller receives fiat (regular money) for the cryptocurrency.

2. Ensuring decentralization of the network. Information about the transactions is stored simultaneously at each miner. That is, there is no single server where all the information is stored, and the recipient and sender of the assets cannot be tracked.

3. Ensuring the issuance of cryptocurrencies. In the process, new blocks are created, resulting in an increase in the amount of cryptocurrency in the network.

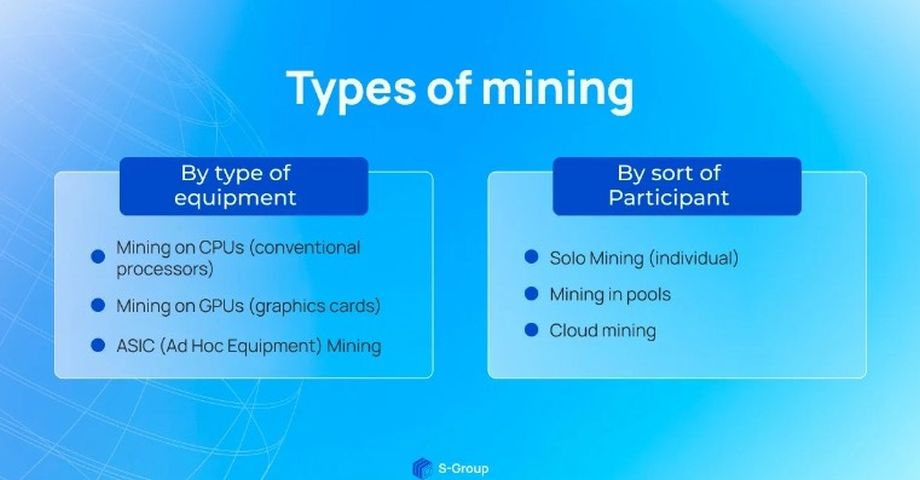

Types of mining

Since mining is a complex and expensive process, there are several classifications: by the type of equipment used for it, and by the number of participants. Let’s take a closer look.

Types according to the type of equipment

1. Mining on CPUs (conventional processors)

Initially, when the complexity was not at such a high level, it was possible to mine coins on ordinary processors at home. Nowadays, on CPUs is not possible due to the lack of power and the complexity. Especially when it comes to top coins like bitcoin or litecoin.

2. GPU mining (on video cards)

Due to the increasing popularity of bitcoin and increasing complexity of bitcoin algorithms, people began to use powerful video cards instead of processors. But over time even their power is not enough.

3. Mining on ASIC (Application-Specific Integrated Circuit)

This is a special and most powerful equipment that was originally designed for mining on certain algorithms. Therefore, ASIC mining is many times more effective and efficient than via CPU or GPU.

In order to increase the power of the equipment and to be able to mine more coins, users began to assemble mining farms. That is, to use not one device, but several. The farms are placed in large rooms with good ventilation and due to the high power allow mining a large number of coins.

Types according to the number of participants

1. Solo or individual mining

Independent mining of new coins on their own equipment. In this case, the miner takes all the profit for himself, including the reward and transaction fee. Due to the increased complexity, bitcoin and other popular coins, individual mining is used to mine promising new cryptocurrencies. Otherwise, it will not be profitable due to the uneven returns from bitcoin mining and equipment/electricity costs.

2. Mining Pools

Pools have emerged due to the increasing difficulty of popular cryptocurrencies. A pool is a server where miners pool their computing power. This increases the chances of being the first to find and mine a block, but also the reward for it is divided between all pool members, depending on the capacity of their equipment. Pools charge a small fee for their services.

3. Cloud mining

Refers to renting computing power from the owners of large farms. Thus miner just joins the cloud farm and pays the rent, and all difficulties with maintenance of network, equipment and other technical points are laid on the shoulders of farm owner.

Risks of mining

Despite the fact that it is one of the most well-known and popular ways of mining cryptocurrency, it has risks.

The first risk is legislative. In many countries, it is not legally regulated, and in some: Taiwan, Vietnam, Ecuador, Romania, Kyrgyzstan it is banned. So before engaging in mining, consult a lawyer to minimize the legal risk.

The second risk is unprofitability. For example, to mine bitcoin on your own, you need huge computing power, for which you will have to spend a lot of money to provide and pay the electricity bills. And with the active development of farms and pools, there is a great risk of wasting money on equipment but not finding a single block.

The third risk is uncertain profitability. It is difficult to calculate how much profit it will bring, because it depends on many factors. For example, the popularity of the coin, the difficulty, the power of the equipment. To roughly calculate the total income, you need to subtract the cost of electricity, as well as the purchase or rental of equipment from the profit received.

Staking — an alternative to mining

If you want to invest in cryptocurrency, but do not want to spend large sums on equipment, and in general want to have a more stable income, staking is the best option. You don’t need expensive equipment to engage in staking. All you need is a certain amount of assets in your account, after which you freeze them and receive a percentage for storage.

The S-Wallet ecosystem has a service SWP token, whose holders get the opportunity to earn passive income from steaking. SWP staking yields range from 50 to 70% per annum. In addition, token holders get access to a host of benefits and privileges in the S-Wallet ecosystem.