Top 5 global companies by market capitalization

The basics of cryptosecurity

The capitalization of a company is the total market value of the company’s shares that are outstanding. Generally, capitalization is expressed in the currency in which a company’s shares are listed. This indicator can be calculated by multiplying the number of outstanding shares by the current market value of one share.

For example, company X has 500,000 shares outstanding at a current market value of $100 per share. The market capitalization of company X is $50 million (500,000 x 100).

Between March 2021 and March 2022, the market capitalization of the world’s most valuable companies reached its most recent all-time high, increasing 11% to $35.16 trillion.

In this article, we look at the world’s largest market capitalization companies, as well as charts of their value ups and downs.

Top 5 global companies by market capitalization

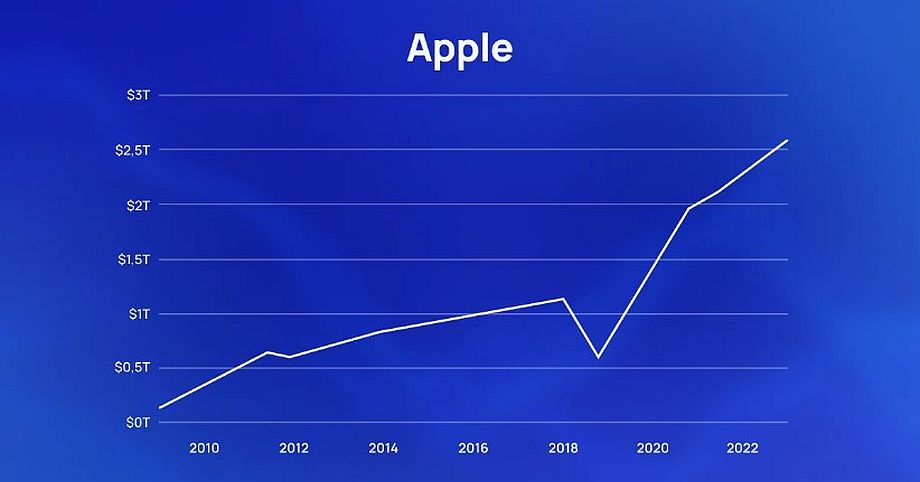

Apple

Apple’s success between 2000 and 2010 was largely due to the launch of the iPhone and iPad. These products revolutionized the mobile technology industry because of their multifunctionality.

The company’s good performance was reflected in the stock market, as Apple managed to hold the title of the world’s largest company by market capitalization from 2012 to 2017. In 2018, Microsoft took that title away from Apple, and Aramco’s turnaround in the stock market in late 2019 pushed Apple into third place.

Apple currently has a market capitalization of $2.1 trillion and the company is in first place.

Microsoft

Microsoft shares have experienced a period of strong growth since 2014, rising more than 400% to $350 in November 2021. In December 2022, the company’s shares were trading at around $243. The company’s capitalization surpassed $1 trillion in April 2019 and now stands at $1.8 trillion. In 2021, the company’s capitalization surpassed $2 trillion, hitting an all-time high.

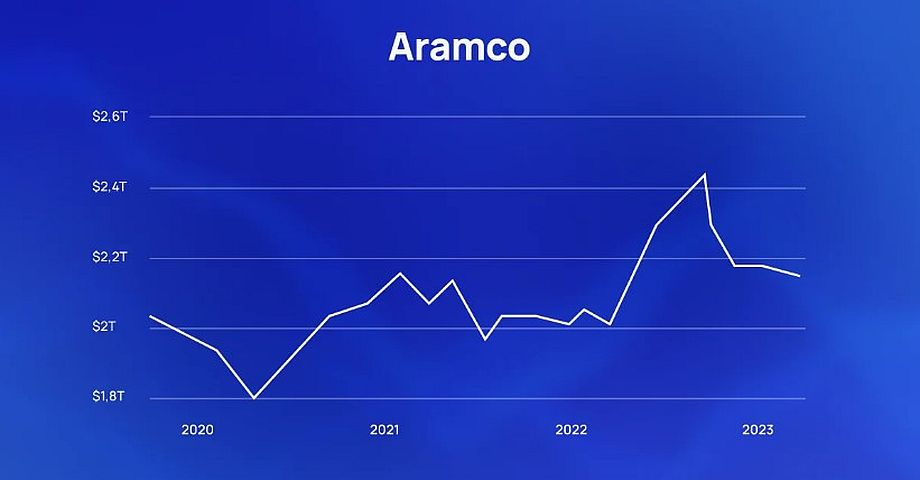

Aramco

Aramco is the world’s largest national oil company, located in Saudi Arabia. The giant processes one in nine barrels of crude oil produced worldwide and has a turnover of more than $300 billion.

In 2016, the oil company announced plans to list 5% of its shares on the stock exchange next year to raise about $100 billion in investment. In December 2019, Aramco debuted on the Riyadh Stock Exchange at 32 rials per share (about $8).

It managed to rise 10% to 35 rials during the first intersession session. In the following days, it reached 38 rials. But due to the crisis caused by the coronavirus in early March, there was volatility in the share price. Since then, it has gradually recovered. As of early 2023, the company’s shares were trading at 31 riyals. The company has a market capitalization of $1.8 trillion.

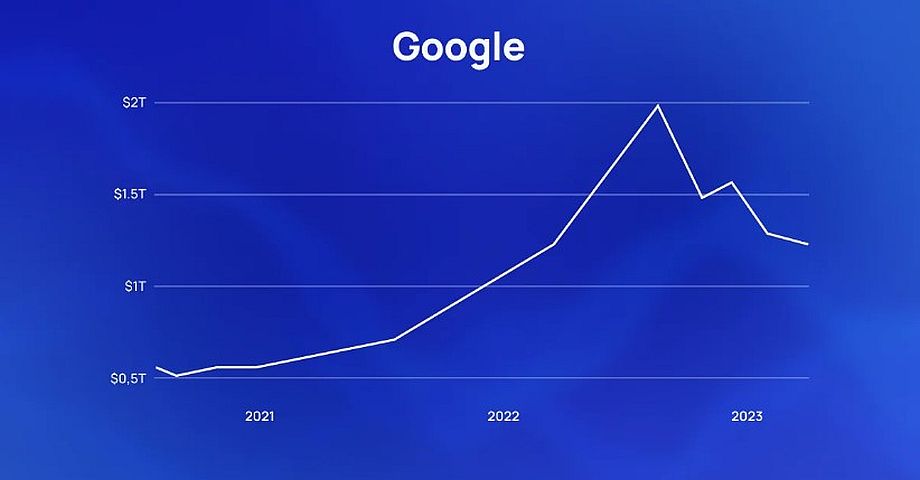

The upward trend in Google’s stock price began in August 2012 with a break above the $650 resistance zone to a high of about $1228 in February 2014. In October 2021, the shares of the company rose above $3,000 and broke their all-time high.

In early 2022, the stock price dropped to the $2260 level. The company’s shares are now trading at $89 because of the decision to split them. A stock split happens when the company decides to increase the number of shares outstanding and distributes new shares to existing shareholders in proportion to their current holdings. The company had a market capitalization of $1.16 trillion at the end of 2022.

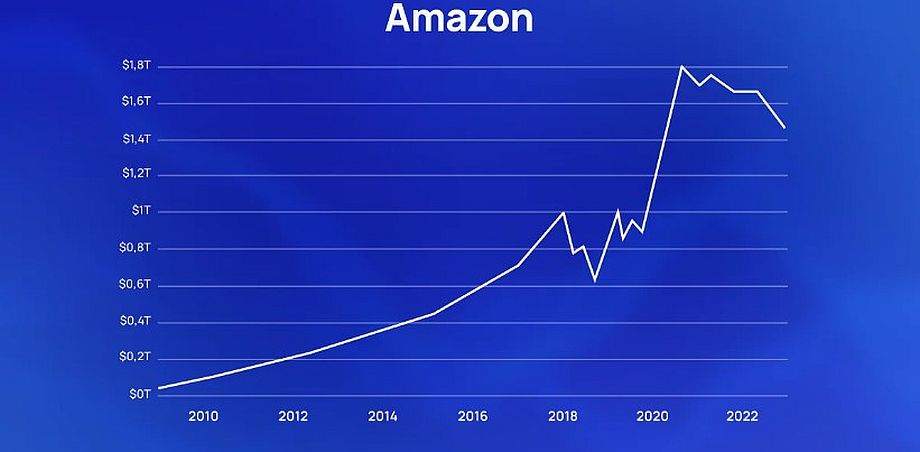

Amazon

Jeff Bezos’s company has followed in the footsteps of such technology companies as Apple and Microsoft. The company’s specialty is to diversify its operations with its own brands: Amazon Music, Amazon Web Services, e-books (Kindle), smart speakers (Echo), etc.

More recently, the company joined streaming platforms with Amazon Prime. From July 2020 to April 2022, the company’s share price hovered between $3760 (its most recent historical high) and $3013.

This high price forced Amazon to perform a 20×1 stock split in June 2022. This reduced the stock price by 20 times, making it more affordable. As of the end of 2022, the stock price was around $88 after a long decline since November 2021. Amazon’s market capitalization exceeded $1 trillion in 2018, and as of the end of 2022, the company’s value on the stock exchange was $869.08 billion. The company’s capitalization is now back up and at $1.06 trillion.

To sum up the top 5 global companies by market capitalization

We looked at a list of the world’s largest market capitalization companies that are attracting investor attention not only because of their strong market performance, but also because of their successful IPOs.

Launching an IPO can be a profitable strategy for companies looking for additional capital to expand their operations and growth. It can provide them with financial stability and increase their potential value in the market. However, potential investors should be cautious, as investing in an IPO can be risky. Despite the success of large companies, there is still a risk that stocks will be undervalued and the market may be volatile.

In the S-Group ecosystem, you can choose the S-IPO direction to invest in IPOs of promising companies. S-IPO provides favorable conditions for investing in the IPO stock market to investors of different levels and assumes all obligations for execution and servicing of investment funds.