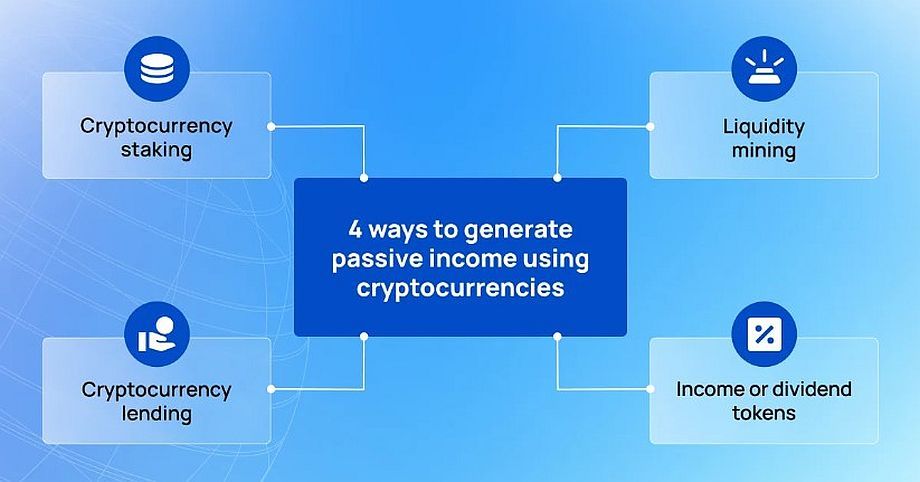

Top 4 ways of passive income in cryptocurrency

Top 4 ways of passive income in cryptocurrency. In this article we’ll take a closer look as well as talk about the advantages and disadvantages of each.

Since the beginning of April 2022, the crypto market has entered a bearish stage or “Crypto Winter” phase. Bitcoin has fallen in price by 55%, Ethereum by 67%, and altcoins are falling. A similar situation was already observed in the crypto world in 2018, when Bitcoin fell 65% within a month.

But, even in times of high market volatility or “Crypto Winter”, the crypto market gives investors the opportunity to earn through sources of passive income.

– Cryptocurrency Staking

– Liquidity mining

– Income or dividend tokens

– Cryptocurrency lending

1. Cryptocurrency Staking

The PoS (Proof of Stake) consensus algorithm enables users to keep the network running by sending their assets to stacking. Thus, cryptocurrency stacking works on a similar principle to a deposit in a bank. The user locks a certain amount of funds in his account for a certain period of time and gets rewarded for this in the form of interest. Once the assets are sent to the stack, the user receives passive income that requires no oversight or intervention.

An analyst at Bein Crypto believes that 2022 will be a breakthrough year for stacking and will make PoS algorithm projects the benchmark. According to crypto analysts, the most promising coins on the PoS algorithm in 2022 will be Ethereum, Dash, Tezor.

Possible profitability. Stacking profitability depends on the specific project, the number of coins and the period for which you “freeze” assets, as well as the type of staking. The average yield ranges from 5 to 20% per annum.

The main advantages of staking:

– Requires no technical knowledge to generate income;

– provision of a guaranteed profit;

– the rate of return is higher than in bank deposits.

Disadvantages of staking:

– For small investments, the returns are small;

– restrictions in terms of time and number of coins that can be sent to the shaking.

Learn more about staking and its types here.

2. Liquidity Mining

Liquidity mining is a decentralized income tool in which users replenish a project’s liquidity pool.

It works as follows:

1. Participants provide their crypto-assets (trading pairs such as ETH/USDT) to the DeFi protocol’s liquidity pool for crypto-trading.

2. In exchange for the trading pair, the liquidity mining protocol provides users with a liquidity provider token (LP), which is required for final redemption.

3. As long as the assets that users have provided remain in the liquidity pool, the project rewards them with their own tokens. The percentage of the reward depends on their share of the pool’s total liquidity.

Possible Returns. The amount of earnings depends on the chosen pool, platform, and investor’s share in the project. That is, the more trades a user makes in a pair, the more he will earn.

The advantages of mining liquidity:

– The opportunity to earn a high income, which depends on the investor and his contribution to the liquidity pool;

– low entry threshold, so users can join liquidity mining with any amount;

– does not require much time to study the market and constant monitoring of the situation.

Disadvantages of liquidity mining:

– due to the high volatility of the crypto market, there is a high risk of losing some returns and invested funds;

– the risk of running into scam projects (scammers). To avoid this risk, it is important to carefully study the project you want to invest in and its asset.

Within the S-Group ecosystem, investors have the opportunity to earn through Liquidity Mining SWP. This is an investment with an average annual return of 140%-160%. With the Liquidity Mining SWP, investors can earn passive income by supplying the SWP/USD currency pair 1:1 equivalent to the dollar to the liquidity pool. Investors receive rewards for providing assets in the form of SWP tokens that have been earned on commission costs over the investment period.

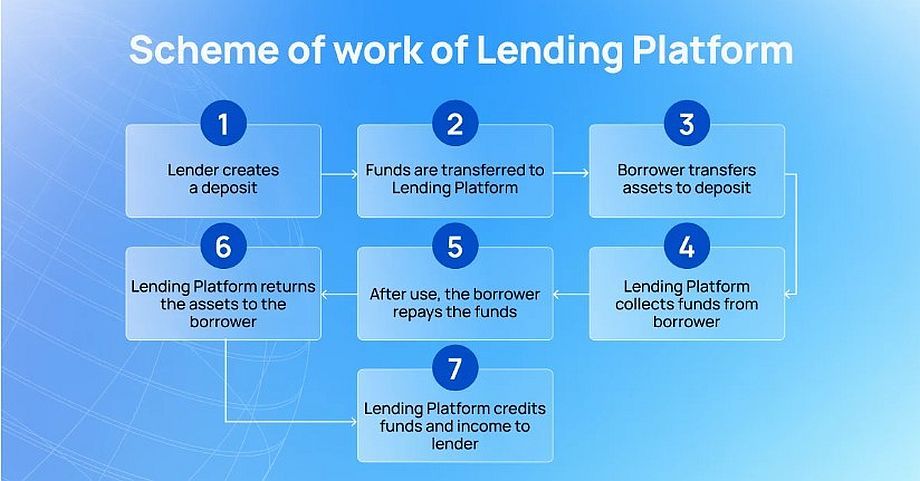

3. Cryptocurrency lending (Lending Platform)

Cryptocurrency lending is one of the best ways to generate passive income in the cryptocurrency industry, both on centralized and decentralized platforms.

Cryptocurrency lending works as follows.

Lenders and borrowers register on the lending platform. Lenders respond to borrowers’ applications by lending them the right amount of assets for a certain period of time. At the end of the loan period, borrowers repay the funds, and lenders receive the amount they lent and a percentage for lending users. The security of the transactions is ensured by smart contracts.

Profitability. The average yield on lending platforms is 12-15% per annum, depending on the platform. Each platform sets its own interest rate. In addition, an investor’s earnings directly depend on how many borrowers take assets from him and in what volumes.

The advantages of cryptocurrency lending:

– high returns;

– the ability to influence the percentage of profitability;

– low risks of losses;

– protection of investors’ assets, since smart contracts control the arrangements.

Disadvantages of cryptocurrency lending:

– Risk of liquidating the loan if the price of cryptocurrency falls;

– vulnerability of some smart contracts to hacker attacks.

4. Income or dividend tokens

Some projects provide investors with income tokens that entitle them to receive dividends and a share of the company’s profits. The way they work is similar to earning with stocks, which allow holders to receive dividends. Some popular examples of such tokens are Kucoin Shares, AscendEx, and Nexo. These projects pay investors a portion of the trading commission income and also entitle them to a portion of the profits.

Another example is the cryptocurrency VeChain (VET). The project generates dividends in the form of another token on the Thor (VTHO) platform. The more VET tokens an investor has, the more VTHO rewards can be earned.

To make a profit, an investor just needs to keep the tokens in their account and receive dividends. But, some projects, require investors to register on the platform and go through KYC verification.

Possible profitability. The investor’s profit depends on the project and the conditions that the company’s management offers to token holders. On average, the yield ranges from 5 to 10% per annum.

Advantages and disadvantages of income tokens:

– Constant and guaranteed profits due to dividend payments;

– high yield;

– a simple way to earn money, which does not require any special technical knowledge and skills.

Disadvantages of buying income or dividend tokens:

– The amount of earnings varies depending on the profits of the company that issues the tokens;

– volatility of the token rate.

There you have it: The top 4 ways of passive income in cryptocurrency.

See more Blog previews on Instagram.