Token burning: what it is & what problems it solves

While in the world of traditional currencies asset destruction seems like a strange and unwise idea, in the world of cryptocurrencies the practice of token burning is quite common.

In a new article, we tell you what token burning is and why projects burn their assets.

Token burning: definition

Token burning is the irrevocable destruction of a certain amount of assets from circulation in order to reduce their issuance. Token burning can be done either by large platforms, cryptoprojects or exchanges, or by private investors who have a lot of capital. For example, Ethereum cryptocurrency creator Vitalik Buterin burned nearly $7 billion worth of Shiba tokens by sending them to a non-existent address.

Coin flaring became particularly popular in 2017. The creators of Binance Coin (BNB), Binance Cash (BCH) and Stellar (XLM) were the first to start burning tokens. Let’s take a closer look at the experiences of cryptocurrency leaders and their reasons for burning assets.

Reasons for token burning

The most important reason for token burning is increased demand for the asset. That is, the higher the demand for a token, the higher its value. Conversely, the lower the demand, the lower the value. Token burning helps projects reduce the number of assets, thereby raising the demand for it.

For this reason, cryptocurrency exchange Binance burns its native BNB tokens quarterly. The project’s White paper planned to burn BNB tokens at a rate of 20 per cent of its three-month earnings. The exchange will burn tokens until the total supply of tokens is reduced by 50%, from 200 million to 100 million.

In addition to Binance, non-custodial platform PancakeSwap periodically burns its CAKE tokens. On June 22, 2021, the platform took $67.9 million of CAKE tokens out of circulation, doubling the price of the asset.

Another prime example is the Stellar team, which last burned more than 50% of its tokens (55 of 105bn). As a result, the token price rose by 20%.

While the increase in asset value is the main reason for token burning, it is not the only reason. What other reasons do projects destroy assets?

– Fixing the price of stabelcoins

Stablecoins are coins with a stable exchange rate that are backed by fiat currencies, cryptocurrencies or an algorithm. Burning tokens helps keep the price of stabelcoins stable through supply control.

One good example of this is Olympus DAO. Its native currency OHM is controlled by an algorithm that regulates the circulating supply of the token and controls its value. If the OHM price falls below a certain point, the algorithm automatically burns off some assets. Conversely, if the price exceeds an acceptable level, new tokens are issued and added, which stabilizes the value of the asset.

Even stackable tokens like USDT, GUSC, USDC and HUSD have burned over $2.8 billion. This has ensured that reserves are transparent once funds are added or withdrawn.

– Increased security

Token burning improves security and avoids spammy transactions. The cryptocurrency payment platform Ripple has adopted this practice. It burns a commission on every transaction, allowing a quick reboot of the system for additional protection against DDoS attacks.

– Bug fixing

Token burning helps to fix bugs that developers made during the coin’s release. For example, the developers of Tether, which issues stackable tokens backed by the US dollar, accidentally created $5 billion in USDT. To avoid destabilizing the 1:1 USD to USDT peg, a decision was made to burn the mistakenly created tokens.

Token burning mechanism

Literally, it is not possible to destroy tokens completely because the main principle of blockchain is immutability. That is, all information about all token transactions is recorded in the blocks. Therefore, the phrase “token burning” sounds more dramatic than it really is.

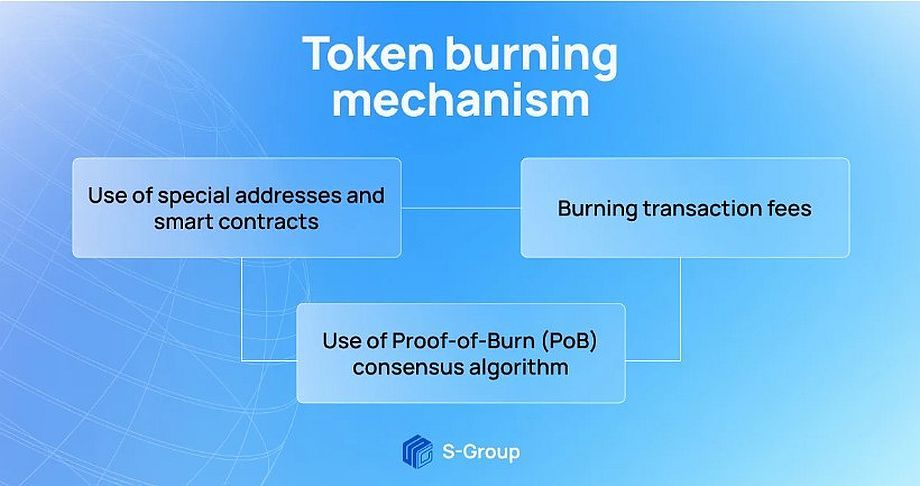

There are 3 token burning mechanisms.

1. The use of special addresses and smart contracts

To burn tokens, they are sent to special burn addresses or eater addresses, the private key from which is destroyed. That is, the assets cannot be withdrawn from these addresses. This ensures that coins sent to these addresses are lost forever. Information about sending assets to the eater address is recorded in the blockchain, after which the network’s nodes confirm the tokens are burned.

In addition to addresses, smart contract addresses can also be used to burn tokens. For example, in the Ethereum network, there is a burn function that can be used to retire ETH and other tokens from various network standards.

2. Burning transaction fees

In August 2021, the Ethereum network underwent the London hard fork. One of its updates involves burning some transaction fees. In this way, Ethereum could become a deflationary cryptocurrency. In addition to Ethereum, other projects, platforms and exchanges use fee burning.

3. The use of Proof-of-Burn (PoB) consensus algorithm

Some projects put the possibility of coin burning in the Proof-of-Born consensus algorithm. Using this algorithm, miners burn their own tokens and receive new ones in return. Thus, the more tokens miners burn, the more assets they can mine.

Summary

The benefits of burning tokens within a project are obvious and are not only limited to increasing the value of the asset. Token burning ensures project liquidity, high security against DDoS attacks, and curbs potential or actual inflation by stabilizing the token price.