Stocks: what they are

Investing in stocks is one of the ways to make passive income. What are stocks, where can they be bought and what kinds of stocks there are — we will consider in this article.

What are stocks and what rights do they give to the owner?

A stock is a security that a company issues in order to attract investment. Shares can be issued at an IPO (Initial Public Offering on the stock exchange) or at an SPO (Secondary Public Offering). SPOs are carried out by companies whose shares are already publicly traded in order to attract additional investment.

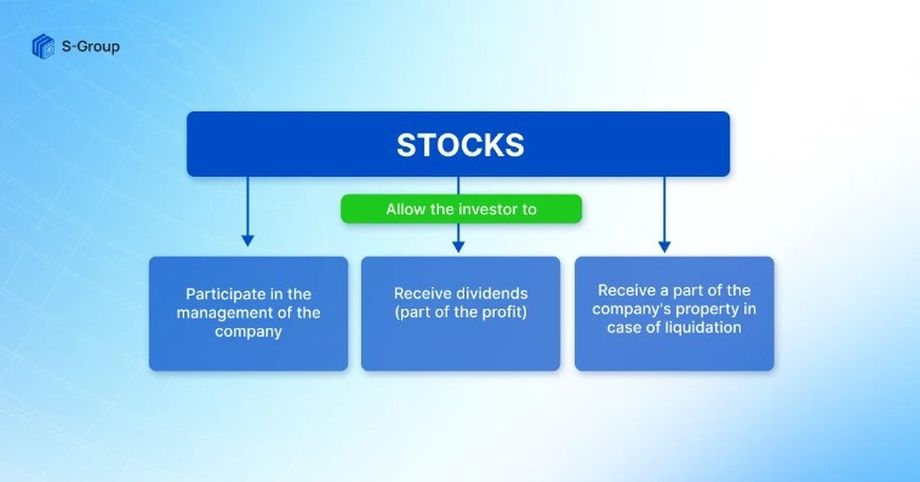

An investor who has purchased a company becomes its co-owner and shareholder. He or she may receive a share of the company’s profits and take part in its management. The investor’s role in management depends on the type of shares and their number.

If you buy a controlling stake (50%+1), the investor has the right to fully manage the company, because he owns most of it. At the same time, the owners of the blocking stake (25% +1) can veto the decision and bring it up for discussion. Shareholders with controlling and blocking stakes are called majority shareholders.

The remaining investors, who have a small number of shares, are minority shareholders. They have no rights to the global management of the organization, but can:

– participate in voting at shareholder meetings;

– receive dividends (part of the profit);

– receive part of the company’s assets in the event of liquidation.

Types of stocks

Stocks differ in the rights that are granted to investors. They can be ordinary and preferred.

Common gives the right to vote at shareholder meetings, but does not guarantee dividends.

Preferred give an investor additional benefits. For example, higher dividends with a predetermined amount and priority in bankruptcy. That is, if a company goes bankrupt, preferred stockholders will receive a portion of the assets after creditors and bondholders.

Preferred securities are divided into two subtypes:

– Non-voting — in return for fixed dividends, shareholders give up the right to vote and take part in the management of the company. The only exception may be voting on the liquidation of the company. But, if the shareholders‘ meeting decides to pay dividends, the holders of non-voting preference shares will receive them first.

– With special rights — the owners of these shares can both receive dividends and priority in bankruptcy, as well as vote. The company may prescribe any other conditions for holders of special rights shares in the articles of association.

You can buy stock on the stock market or over-the-counter directly from a person. Experienced investors recommend buying assets on the stock exchange because everything is more transparent and reliable there.

The stock exchange assigns three levels of listing. At the first and second level, securities of the largest and most reliable companies are listed. To get on this list, organizations must report regularly to the exchange and publish information about themselves on the Internet. At the third level, the requirements are the lowest.

How an investor can make money on stocks

Some investors buy assets to participate in the management of a company, others to profit from them. For example:

- By receiving dividends. This is a portion of the profits that is divided among the shareholders. Some investors keep the dividends received and use them as passive income. Dividends are like a deposit in a bank. Only in the case of a deposit you can predict how much you will receive in the end, but in the case of a company it is difficult to predict how things will go.

- On the price difference. If the organization develops, its shares go up in price. It means that you can sell them for more than you bought them, and the difference of these prices will be the profit.

Pros and cons of investing in securities

Let’s start with the pros:

– buying and selling stocks makes more profit than trading options or currencies;

– it is possible to become part-owner of a well-known organization;

– receiving a portion of the profits;

– shares of the first and second listing levels are always liquid, which means they are easy to sell;

– invested money does not lie idle, and bring income, which is more than a deposit in the bank.

One of the disadvantages is the volatility of the stock price, since all events which happen to the company (good or bad) are instantly reflected in the value of the shares. For example, on October 5, 2021, there was a global crash of Facebook, WhatsApp, Instagram, which caused Facebook’s shares to plummet in value and Mark Zuckerberg to lose $6.6 billion.

Stocks and bonds: which is more profitable and how they differ

A stock is a share of a business that gives you the right to receive a portion of the profits. A shareholder’s income depends on the company’s performance, but there are no guarantees. If the stock falls in value, the shareholder can sell it.

A bond can be compared to a loan that a company takes from an investor. He receives a bond as a receipt with a clearly stated deadline for repayment. This means that a person’s profit does not depend on the company’s income. On a specified date, the organization must pay the investor the money invested.

Compared to bonds, stocks are a risky instrument, but their potential return is higher. But, if stability and predictability in finances are important to you, it is more logical to choose bonds. We’ll talk about them in more detail in the following articles.

Experienced investors keep two types of assets in portfolios: shares and bonds.

Tips for investors

To make an investment in stocks and bonds profitable, it’s important not to invest all your money in just one company. Choose several institutions, preferably in different industries. Keep track of what is happening with the companies you choose to understand which way the rate will move. Lastly, keep in mind the direct correlation between rises and falls in stocks. If an asset starts to rise sharply, it means it could fall just as sharply.

With S-IPO, you can buy shares of promising startups and get the maximum income with a minimum investment. Security of investment is ensured by a personnel manager with full support throughout the transaction, as well as a team of analysts searching for investment proposals, analysis, and risk assessment. Read more here.