Balancing and re-balancing an IPO investment portfolio

The content of an investor’s investment portfolio must be matched with his or her financial goals and risk tolerance. By creating an investment plan, he or she can add different types of low-risk and high-risk assets to the portfolio: stocks, currencies, real estate, bonds. The balancing and rebalancing of the investment portfolio helps the investor to stick to the plan.

In this article, we describe what balancing an investment portfolio is, why it is important to rebalance it periodically and how these instruments affect IPO investments.

Balancing an IPO investment portfolio: definition

Balancing an investment portfolio is the allocation of assets in a ratio that meets the investor’s established financial goals and risk tolerance. These factors are determined by his current financial situation as well as the investment strategies he chooses.

For example, an investor intends to invest in stocks, bonds, and currencies. After creating an investment plan, he determines the optimal balance of his portfolio, in which stocks will represent 45%, bonds – 35%, and currencies – 20%. Then he fills the portfolio with the appropriate assets in the specified percentage ratio.

Asset allocation is an individual process for each investor, so there are no universal solutions in this matter. More conservative investors allocate their portfolios mostly to low-risk assets, such as bonds, which provide a moderate but stable income. Less conservative investors prefer portfolios that contain a high percentage of high-risk assets, focusing on their high returns.

Over time, the ratio of assets in an investment portfolio will change. This is due to the constant dynamics in the world economy, as well as changes in the prices of certain assets. To keep the investment portfolio balanced, it needs periodic rebalancing.

Rebalancing an investment portfolio: why is it important

Rebalancing is changing the ratio of assets in an investment portfolio by buying and selling them. With rebalancing, an investor can return to the original asset ratio or form a new one if his or her financial goals and risk tolerance have changed.

It is recommended that an investor assess the contents of the investment portfolio at least once a year in order to respond to changes in time. It is believed that a portfolio should be rebalanced if the asset ratio has changed by more than 5%.

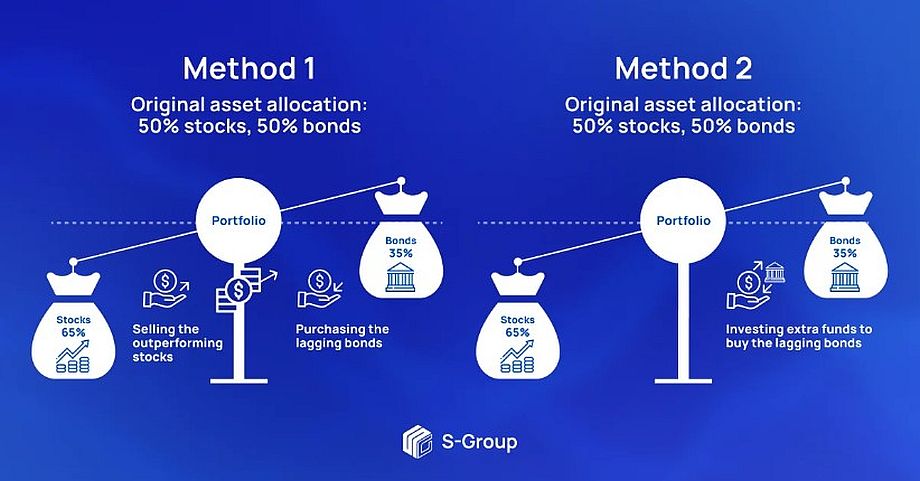

Rebalancing can be done in two ways:

– sell some of the outperforming assets and buy some of the lagging assets;

– buy up the lagging assets by investing extra funds and rebalance the investment portfolio.

For example, an investor’s portfolio originally consisted of 50% stocks and 50% bonds. A year later, the ratio has changed: stocks make up 65% of the portfolio and bonds 35%. To rebalance the portfolio and return to the original asset ratio in the first way, the investor must sell some of the stocks and buy new bonds with this money. In the second method, the investor doesn’t sell stocks, but invests extra funds and buys bonds in the amount that will return the investment portfolio to its original ratio.

Investment portfolio with IPO shares: examples

Forming an investment portfolio with IPO shares involves several steps.

1. Evaluating investment objectives. Determine your investment goals, the timing and level of risk acceptable to you, and make an investment plan.

2. Explore companies and industries. Analyze companies that are planning IPOs and select those that match your investment plan.

3. Balancing the investment portfolio. Determine the optimal percentage for IPO stocks in your investment portfolio.

4. Monitoring and regular rebalancing. Monitor the performance of the IPO stocks in your portfolio and perform periodic rebalancing to keep your risk level and asset ratio in line with your investment plan.

An example of balancing an investment portfolio with IPO stocks.

Key conclusions of Balancing an IPO investment

Forming an investment portfolio requires a thorough analysis of investment opportunities and risk tolerance, as well as a clear definition of financial goals. By going through all the stages of preparation, an investor will be able to fill his or her portfolio with the most suitable assets and increase capital.

Balancing and rebalancing an investment portfolio allows an investor to keep the desired ratio of risk and potential income from investments. Therefore, it is important to remember to periodically assess your assets and monitor price changes closely.