5 myths about investing

The financial market is filled with various stereotypes that it is important to combat when creating a true investment culture. We are not saying that this is a quick and easy way to make money. A niche can be risky and needs to be explored. So, let’s talk about 5 myths about investing.

Myth 1. Investing is a scam

Traditionally, this myth is associated with pyramid schemes. Indeed, investing is associated with a negative reputation, but a lot depends on the choice of intermediaries. If you invest through a brokerage company that is licensed by the country’s central bank, then there are no legal risks.

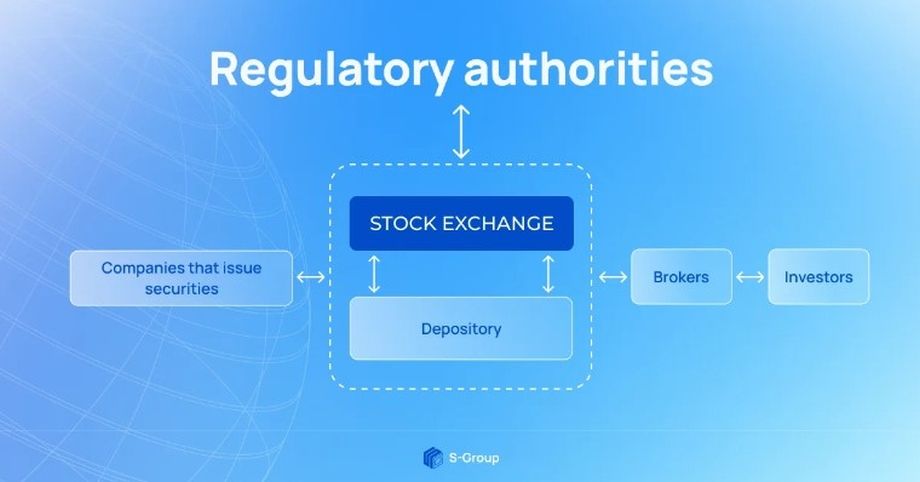

The work of the exchange is a well-functioning and strictly protected mechanism. Companies that need money come to the exchanges. They can take out a loan from a bank, or they can turn to investors for help by placing their shares and bonds on the stock exchange. Typically, companies use both lending and issuing securities. When buying securities through a licensed broker, information about the assets is recorded in the depository. Therefore, if a broker goes bankrupt or his license runs out, your assets are preserved. It is enough to contact the depository and transfer to another broker.

Of course, you should only choose reliable intermediaries who have a valid central bank license, experience in the market and a positive reputation. If you are a beginner, start investing with the simplest and most understandable, with the product that you understand.

Myth 2. Investment is a casino

Many believe that this is a lottery, stocks will either rise or fall, and it is unrealistic to predict this process. There are risks in the markets. The higher the profitability of the instruments that are offered to you, the higher the risks. What are the risks in investments:

– systemic or market or global risk. You cannot influence him in any way. For example, a pandemic is a systemic risk that affects all classes of financial assets.

– non-systemic risk is associated with a specific business. For example, you buy shares in a company that subsequently faces ineffective management, competition, and financial instability. Surely her shares are falling in value

In addition to stocks, which are familiar to everyone, there are also bonds on the market. They are very similar to bank deposits. When you buy a bond, you receive interest income in a certain period. You hold the bond until it is redeemed, that is, when your amount is returned to you.

Macroeconomic factors are behind the dynamics of exchange-traded assets. The market will always be influenced by supply and demand. In 95% of cases, market trends have a logical explanation, with the exception of small short-term fluctuations. It is incorrect to compare long-term investing with casinos, since the real economy influences investments.

Myth 3. Investing only for the rich

Today you can start investing with only $ 15. This is a long-term investment. You can invest $ 15 and collect capital in 10-30 years, provided that you add $ 15 every month. If you reinvest your income, that is, you will not withdraw dividends or interest, but will buy new assets with them, your capital will grow faster.

You can invest starting from different amounts. With $ 150, you can create a diversified portfolio – many different assets, the dynamics of which are not related to each other. So, if some assets fall, others grow, risks are minimized.

Myth 4. Investment for financiers and economists

Even a person who is far from economic education and mathematical ability can own a safe investment portfolio. You do not need to buy complex instruments for this, you can start with a simple one, for example, bonds.

In order to understand investing, it is not necessary to graduate from a financial university. Today, a lot of literate and easy-to-understand literature is available that allows you to understand the issues of interest. Famous authors: Warren Buffett, Benjamin Graham, William Bernstein.

Myth 5. Investing takes a long time

There is no need to monitor the news of the investment market every day in order to make a profit. Some people confuse trading with investing. Trading is trying to capitalize on short-term price fluctuations, while investing is buying assets with a long-term goal. Therefore, if you are a long-term investor, you do not need to constantly monitor all the news. It is enough to follow the companies that are in your diversified portfolio.

It is also important to filter information noise by separating true information from false information. To follow the trends in the economic market, it is enough to monitor the news once a month. In our media center you will find a lot of useful and relevant information on the topic of investing and not only. And you can quickly get information by subscribing to our social networks.