Prospects for investment in blockchain projects

The amount of investment in blockchain projects and technologies has grown significantly over the past few years. According to Crunchbase, in 2017, total investment was about $1.3 billion, and by 2021 that figure had risen to $20 billion. This trend indicates a growing interest in blockchain technologies and their potential.

Blockchain technologies continue to attract the attention of investors, researchers, and entrepreneurs because of their potential to transform the economy and various industries. In this article, we look at blockchain investment trends, examples of successful startups, as well as approaches to selecting projects for investment and the risks associated with it.

The growth potential of blockchain technology

The blockchain sector is projected to grow to nearly $40 billion by 2025, with a growth rate of 67.3% per year. This growth trend is due to an increase in the volume of financing and investment in blockchain-based businesses. Originating in the financial services industry, blockchain technology is expanding into new areas every day.

These advances will create a promising investment environment that includes cryptocurrencies, initial coin offerings (ICOs) and accelerated transaction services.

Although blockchain technology was originally developed to simplify cryptocurrency transactions, it has also found application in traditional currency transfers. Financial institutions and banks use blockchain solutions to secure customers’ online transactions by enabling interaction between fiat and digital currencies.

How to choose a blockchain project for investment

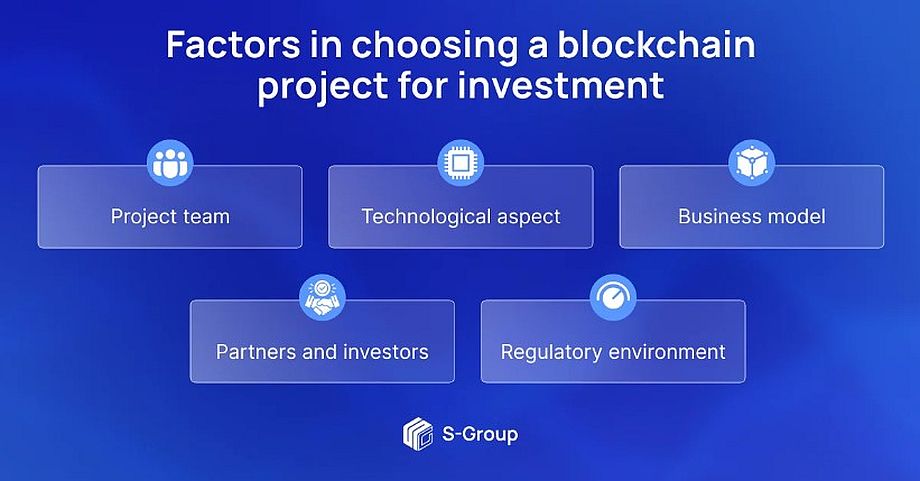

The following factors are useful to consider when choosing a blockchain project for investment.

1. Project team. Education, work experience and reputation of team members.

2. Technological aspect. Availability of a finished product or prototype, as well as the uniqueness and competitiveness of the technology.

3. Business model. The clarity and sustainability of the business model, as well as the potential for scaling and growth.

4. Partners and investors. The presence of large and reputable partners and investors, confirming the trust in the project.

5. Regulatory environment. Assessment of legal risks and possible problems with regulators in different jurisdictions.

Benefits and risks of investing in blockchain projects

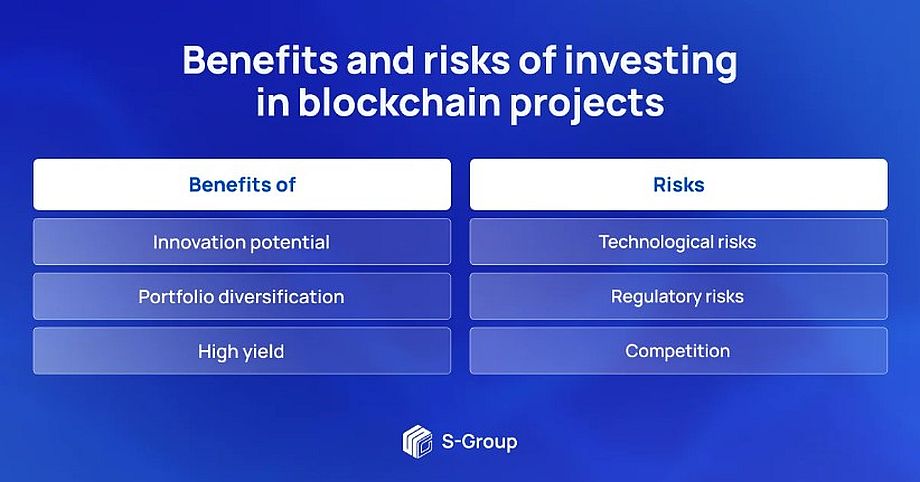

Investments in blockchain projects offer a number of benefits.

– Innovation potential. Blockchain technology can bring revolutionary change to many industries, creating significant potential for project value growth.

– Portfolio diversification. Investing in blockchain projects can improve investor portfolio diversification and reduce overall risk.

– High yield. Blockchain projects that perform well can offer high returns to investors.

Investing in blockchain projects also involves risks.

– Technological risks. Blockchain technologies are still developing, and some projects may face technical problems or limitations.

– Regulatory risks. Governments may impose strict regulatory restrictions that could affect the growth and success of blockchain projects.

– Competition. The market for blockchain projects is becoming increasingly competitive, and only some projects will survive and succeed.

Blockchain technology areas of application

Blockchain in agriculture

Smart contracts and IoT devices can be integrated into the agricultural system, providing transparency of product origin and supply management. Investments in such projects can lead to streamlined processes, reduced losses and create valuable solutions for the agricultural sector.

Blockchain for intellectual property

Investments in platforms that use blockchain to manage intellectual property rights can ensure fair distribution of royalties and prevent piracy. Transparency and decentralization allow creators to control their rights and receive rewards.

Blockchain in healthcare

Implementing blockchain technology into healthcare systems can ensure the security and privacy of patient data. Investments in such projects can help create unified databases and reduce medical errors associated with inaccurate information.

Blockchain in education

Education projects that use blockchain can offer secure and transparent systems for storing and verifying academic notes. Investing in such platforms can help counter diploma falsification and speed up the credential verification process for candidates.

Blockchain in countering product counterfeiting

Developing and deploying blockchain solutions to trace products from manufacturer to consumer can reduce the risk of counterfeiting and provide transparency about the origin of items. Investing in such projects can help create reliable supply chains and protect consumer rights.

Investments in non-obvious areas of blockchain applications can provide high yields and solve a number of complex problems. Benefits include transparency, decentralization, security and cost savings. However, before investing in such projects, a thorough analysis and assessment of the potential of each particular initiative is necessary.

Platforms for investing in blockchain projects

If you are interested in finding promising blockchain startups to invest in, the following resources and platforms may be helpful.

1. Crowdfunding platforms. Sites like Kickstarter, Indiegogo and SeedInvest often offer opportunities to invest in early-stage startups, including those based on blockchain technology.

2. Specialized investment platforms. Platforms such as BnkToTheFuture and CoinList focus on providing investment opportunities in cryptocurrency and blockchain projects.

3. Accelerators and incubators. Acceleration and incubation programs such as ConsenSys Labs, Y Combinator and Techstars often support blockchain startups and help them grow and attract investment.

4. Social media and blogs. Keep an eye on profile blogs, publications and social media groups such as Twitter, Reddit, Telegram and LinkedIn, where new blockchain projects often present their ideas and attract investments.

5. Conferences and events. Attend blockchain and cryptocurrency conferences, trade shows and events such as Consensus and Web Summit to learn about new startups and meet founders and investors.

6. Analytics platforms and databases. Resources such as Crunchbase, CoinGecko and ICOdrops provide information about blockchain projects, their funding and stage of development.

When using these resources and platforms, it is always important to conduct your own research, analyze and assess each project in terms of its potential and risks, and consider your own investment goals and preferences.

Conclusion Blockchain Projects

Investments in blockchain projects and technologies offer great potential for returns, especially given the growing interest in this area. However, investors should carefully analyze and evaluate various project-specific factors, such as the team, technology, business model, partners and investors, and the regulatory environment.

In addition, it is important to consider the benefits and risks associated with investing in blockchain projects to balance the portfolio and optimize return potential. Investing in blockchain can yield very significant returns for those who closely monitor trends and choose the right projects to invest in.