Crypto lending: definition and perspectives

Every year the popularity and global capitalization of cryptocurrencies grows and today amounts to $67.83 billion, and 97% of holders of digital assets consider them a promising investment and a reliable source of income. This popularity, which is only growing every year, contributes to the emergence of new ways to make money from cryptocurrency. One such way is cryptocurrency lending, which has gained popularity with the active development of DeFi-platforms.

What is cryptocurrency lending for lenders and borrowers, how does the cryptocurrency process work, and what are the advantages and disadvantages? Continue reading this article to learn the answers to these questions.

What is cryptocurrency lending and how does it work?

Cryptocurrency lending is a form of decentralized financing that allows users to receive or lend out cryptocurrency for interest.

The main feature of cryptocurrency lending is that there is no official intermediary in the process, which approves or rejects the loan and monitors compliance with the agreement. Smart contracts, which automate the process and keep track of repayment terms and costs, are responsible for the security and compliance with all agreed upon terms.

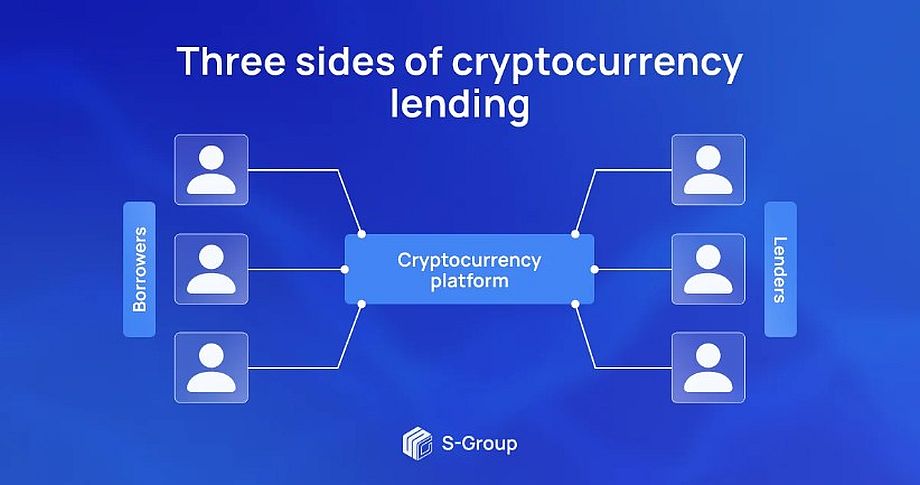

There are three parties involved in the process of cryptocurrency lending: the lender, the borrower, and the platform that enables users to issue or receive loans.

Crypto lending for lenders

The second side of the process, after the crypto platform, is investors who send their assets to the platform pool and want to earn passive income by lending their cryptocurrency funds to other users and receiving a percentage.

For example, you have 10 BTC that you don’t want to sell or exchange for another cryptocurrency, but want to use for passive income. In that case, you can choose a cryptocurrency platform and replenish its liquidity pool with your assets.

The platform, in turn, will use the assets provided to lend to other users, and you will be paid interest for funding the pool. The interest rate for extending credit can vary depending on the platform you choose, but the average is 3-7%, sometimes 17%.

Crypto lending for borrowers

Users who want to borrow cryptocurrency can do so on condition that they pledge their cryptoassets. Then, as they repay the loan they receive, they return the collateral left behind to the crypto platform. The amount of credit a user can receive is calculated based on the amount of collateral left behind, using the ratio of credit to the value of the collateral. That is, if this ratio on the platform is 50%, the user must have at least 5 ETH on their balance in order to receive credit of 10 ETH.

Important. When providing cryptoassets as collateral, the ownership of the currency remains with the borrowers. The only restriction is the impossibility to trade or exchange pledged assets.

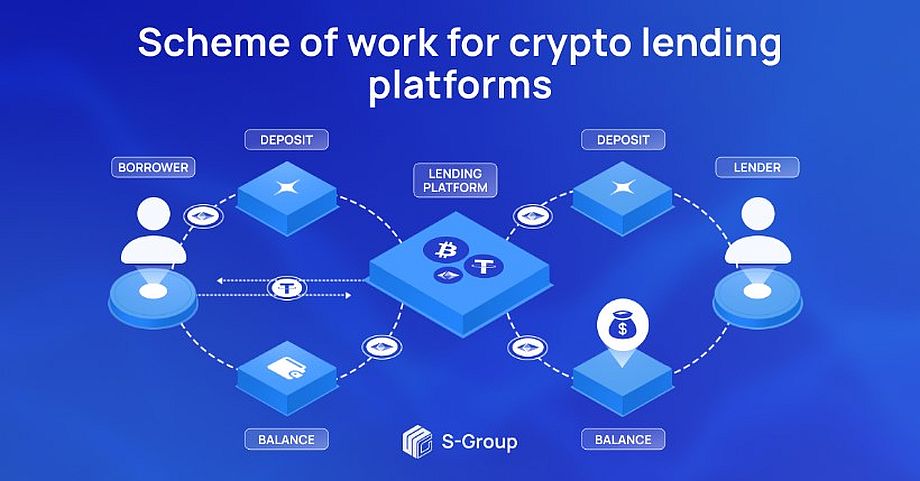

Schematically, the process of cryptocurrency is as follows.

1. The lender chooses a platform and creates a deposit, sending their assets to the liquidity pool.

2. Funds are received on the platform.

3. The borrower joins the platform and sends pledged assets.

4. The platform removes collateral from the borrower.

5. The borrower receives the loan and repays the funds after use.

6. The platform pays interest to the creditor.

7. The platform accrues funds to the lender at the end of the lending period.

Types of crypto lending platforms

There are two main types of cryptocurrency platforms: centralized and decentralized.

Centralized crypto platforms. On such platforms, borrowers go through KYC and AML procedures, and lenders have to trust the platform, as it controls all transactions. The main risk is the loss of funds due to hacker attacks, as in this case all assets of the platform will be exposed to hacking.

Decentralized crypto platforms. Based on blockchain technology and smart contracts, they operate without intermediaries. Therefore, users interact directly with each other. Advantages include increased security, transparency and low fees.

Main types of crypto loans

There are two basic types of cryptocurrencies, which differ from each other in terms of functionality and the opportunities they provide.

Flash Loans

Flash loans provide an opportunity to obtain a loan without providing collateral, but with a mandatory repayment of funds in a single transaction on a single blockchain blockchain. That is, if the borrower cannot repay the loan funds, the transaction is canceled before it is confirmed on the blockchain. Smart contracts then have complete control over the lending and repayment process. This makes flash loans relatively safe for lenders, as they can be assured of the repayment of their funds.

The main advantage of flash loans – receiving funds without the need to leave collateral and involvement of intermediaries.

Collateral Loans

Collateral loans allow users to obtain a loan by providing collateral in the form of cryptocurrency or other assets. The borrower submits a request for a loan, specifying the amount he wants to borrow, the repayment terms, and the proposed collateral (cryptocurrency or other assets). The collateral should usually exceed the loan amount to protect the lender from market fluctuations.

Next, the cryptocurrency lending platform or smart contract evaluates the proposed collateral, taking into account the current market value of the assets and the degree of risk. If the collateral meets the requirements, the loan can be approved.

Important. The borrower must repay the loan, along with interest, by the due date. If the borrower meets their obligations, the collateral will be released and returned to the borrower.

If the borrower fails to repay the loan on time or the value of the collateral falls below a set threshold, the platform or smart contract can sell the collateral to cover the debt.

How to choose a crypto lending platform?

The market has developed a large number of centralized and decentralized platforms that offer cryptocurrency services.

But it is very important to choose a reliable platform so as not to lose money.

1. Research. Research the available platforms, their terms and services, and carefully review websites and read user reviews.

2. Security. Make sure the platform is secure, check its history and security measures.

3. Rates and Conditions. Compare interest rates, loan terms, minimum and maximum amounts, and other conditions on different platforms.

4. Stablecoin support. The availability of stabelcoins can reduce the risks associated with cryptocurrency fluctuations.

5. Liquidity and volume. Choose platforms with good liquidity and sufficient trading volume to ensure timely execution.

6. Support and customer service. Make sure the platform offers quality support and customer service in your language.

7. Intuitive interface. Prefer platforms with a simple and intuitive interface.

8. Value-added services. Consider platforms that offer value-added services, such as insurance for funds or the ability to earn money from steaking.

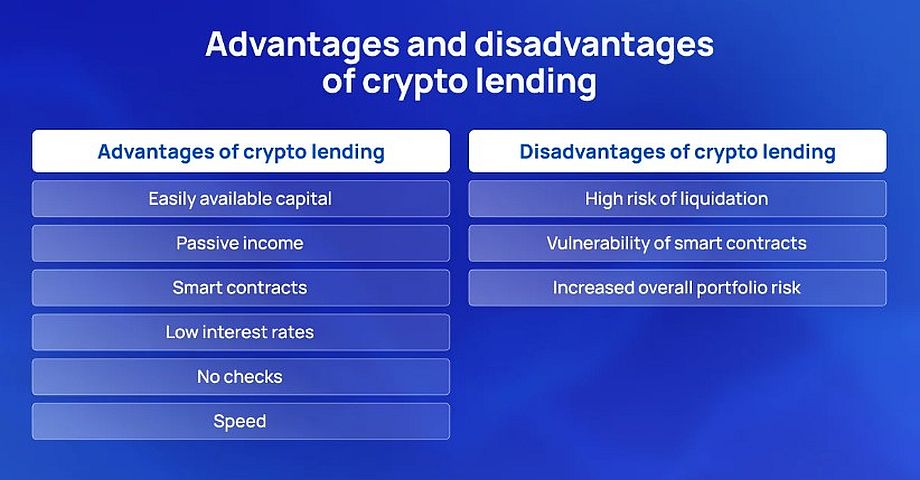

Advantages and disadvantages of crypto lending

The benefits of cryptocurrency lending.

+ Easily accessible capital. Users can access credit without having to contact traditional banks.

+ Passive income. Investors can earn interest by lending cryptocurrency to other users.

+ Smart contracts. Automatic credit management, ensures transparency and reliability of transactions.

+ Low interest rates. Compared to most traditional banks, interest rates on cryptocurrency platforms are much lower.

+ No checks. Unlike taking loans from traditional banks, users don’t have to go through security checks and wait for approval. The only thing is KYC verification on centralized cryptocurrency platforms.

+ Speed. Funds are credited to the borrower’s account within a few hours, and most loans DeFi within minutes.

Disadvantages of cryptocurrency lending.

– High liquidation risk. If the value of the collateral falls below a certain level, the borrower will have to replenish the collateral or risk losing their money.

– Vulnerability of smart contracts. In some cases, smart contracts can be vulnerable to attacks, putting users’ funds at risk.

– Increased overall portfolio risk. Borrowing and lending can increase the risk of an investment portfolio, especially when leverage is involved.

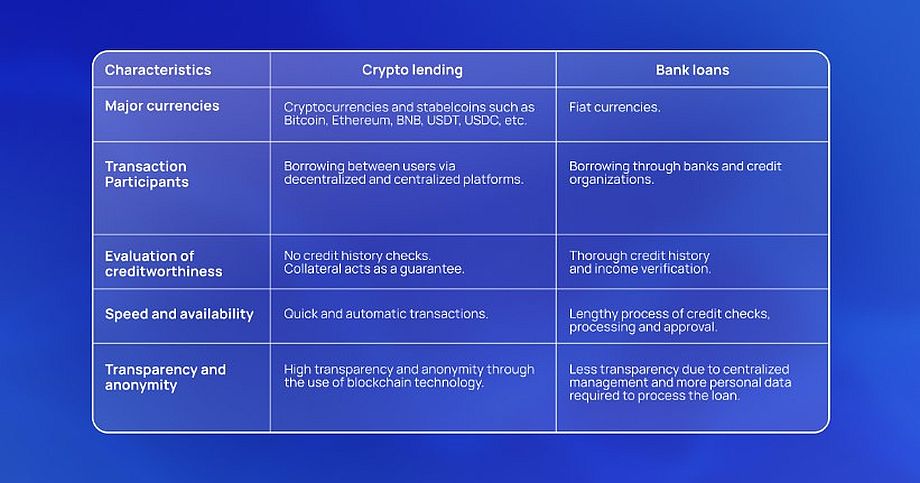

Cryptocurrency vs bank loans: a comparison

Despite the similarities in the very process of lending, cryptocurrency lending is very different from traditional bank loans. Let’s look at the key differences.

Currency basics. Cryptocurrencies use digital currencies, such as bitcoins and ethers, and are based on blockchain technology, while traditional loans use fiat currencies (dollars, euros) and are based on centralized financial systems.

Participants in the loan transaction. In the case of cryptocurrencies, borrowing takes place between peers, with decentralized financial platforms (DeFi) acting as intermediaries. Traditional loans are provided through banks or other financial institutions, which act as intermediaries.

The credit assessment process. Cryptocurrency loans are often granted without a credit history check, as collateral in the form of cryptocurrency ensures repayment. Traditional loans require a thorough check of the borrower’s credit history and income, and collateral can be real estate, a car, or other property.

Speed and availability. Cryptocurrencies provide fast and automatic transactions, and are available anywhere in the world with internet access. Traditional loans take longer to process and approve, and are limited by terms and conditions set by financial institutions.

Transparency and anonymity. Thanks to blockchain technology, cryptocurrencies offer high transparency and the relative anonymity of transaction participants. Traditional loans have less transparency because of centralized systems and require more personal information to obtain credit.

Conclusion

Cryptocurrency lending is a relatively new trend in the cryptocurrency market, which allows users to borrow and lend cryptocurrency with a certain fee or interest.

The main advantages of cryptocurrency lending are the easy availability of capital, the ability to earn passive income, and the high security afforded by the use of smart contracts. However, cryptocurrencies also have disadvantages, such as high liquidation risk, vulnerability of smart contracts and increased overall portfolio risk.

Overall, cryptocurrency lending is an innovative approach to lending that opens up new opportunities for borrowers and investors. With advantages such as speed, accessibility and transparency, cryptocurrencies are becoming more and more popular by the day and could significantly change the financial industry in the future.